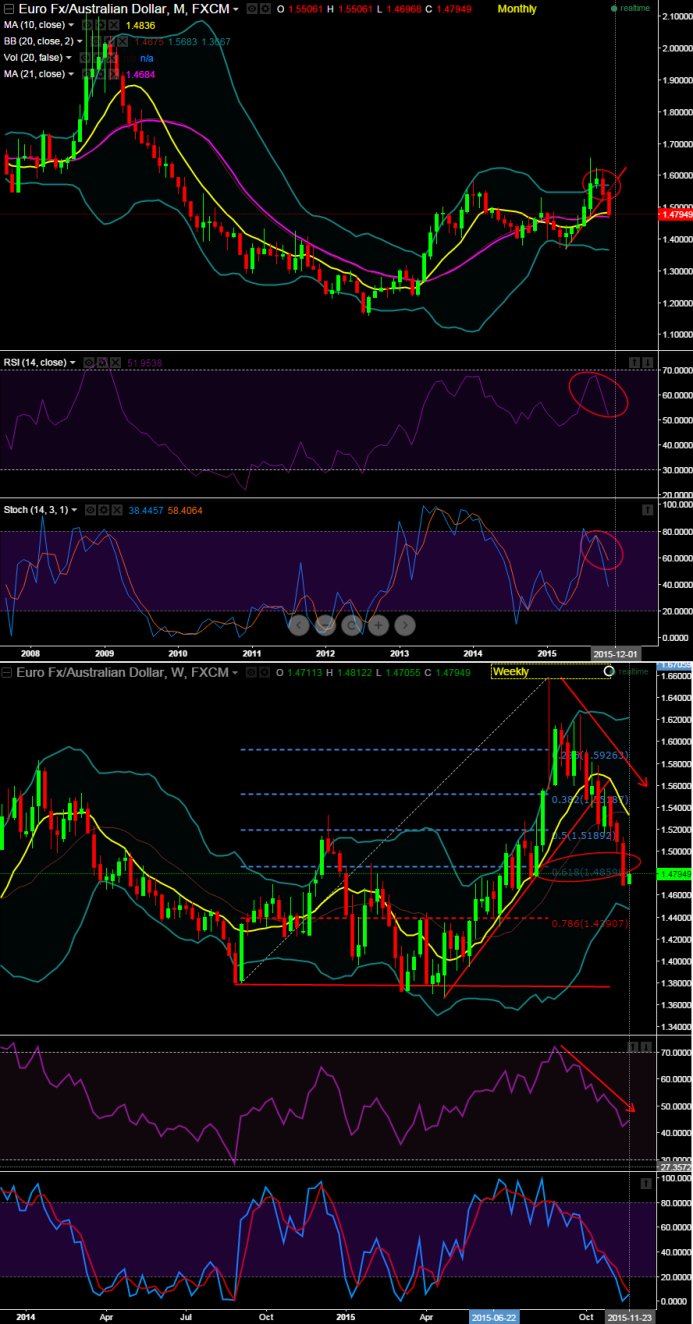

The pair has retraced more than 61.8% way below 10DMA from the highs Gravestone Doji (1.6584).

This has been achieved after the formation of Gravestone doji (1.5583) candle with long upper shadow.

But for now we again like to reiterate even though prices are showing strength today, as it is falling well below moving average curve long term bearish trend to sustain.

We spotted out a gravestone pattern again at 1.5708, so we believe with this bearish indication the pair to either remain stagnant or drag towards 1.5475 levels if it breaks current levels of 1.5554 which is a trendline support. If it manages to hold these levels then it would bounce back again.

More importantly, leading oscillators on monthly charts are converging these bearish sentiments.

RSI curve is steeply trending below at 51.9538 and %D line crossover has been maintaining beautifully near 60 levels (current %D is at around 58.3835 and %K is at 38.3730) but there has been slight divergence on weekly charts.

You can also observe the pair on monthly charts, this has broken channel line support earlier at around 1.5506 levels (see circled area) with spot FX at 1.4794 slipping below 10DMA again which is again a bearish sign.

Overall now the pair is inching towards little upwards slowly, while weekly leading oscillators puzzle by signaling divergence to the dropping prices.

In our opinion on these technical reasoning creates best swing trading opportunity, it is better to use these rallies after the 61.8% retracement and stay calm with earlier ITM long puts and any minor upswings can be utilized OTM put writings.

FxWirePro: EUR/AUD breaks below 61.8% retracement, swing trade using fibo

Monday, November 23, 2015 6:27 AM UTC

Editor's Picks

- Market Data

Most Popular