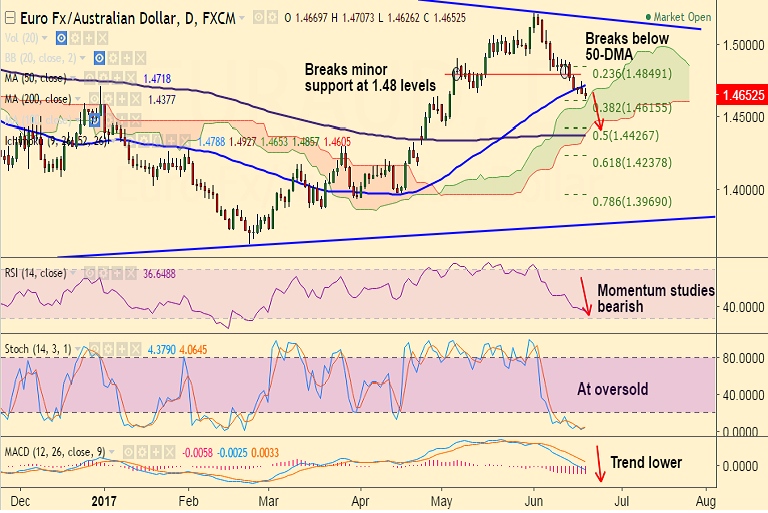

- EUR/AUD has shown a break below 50-DMA at 1.4718, we see scope for further downside.

- We see bearish divergence from price action on RSI and Stochs on the daily chart.

- MACD shows continuation of trend lower. Next bear target is 200-DMA at 1.4377.

- Bearish invalidation seen on close above 50-DMA at 1.4718. Pair could then rebound till 20-DMA at 1.4933.

Support levels - 1.4615 (38.2% Fib), 1.4573 (cloud top), 1.4443 (May 2 low), 1.4377 (200-DMA)

Resistance levels - 1.4702 (5-DMA), 1.4718 (50-DMA), 1.4849 (23.6% Fib), 1.4919 (20-DMA)

Call update: Our previous call (http://www.econotimes.com/FxWirePro-EUR-AUD-holds-minor-support-at-148-break-below-could-see-further-drag-752376) has hit all targets.

Recommendation: Good to go short on rallies around 1.4680/90, SL: 1.4730, TP: 1.4615/ 1.4575/ 1.4450

FxWirePro Currency Strength Index: FxWirePro's Hourly EUR Spot Index was at 68.1476 (Bearish), while Hourly AUD Spot Index was at 42.837 (Neutral) at 1040 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.