Potential Reversal Zone- $750

Key Highlights

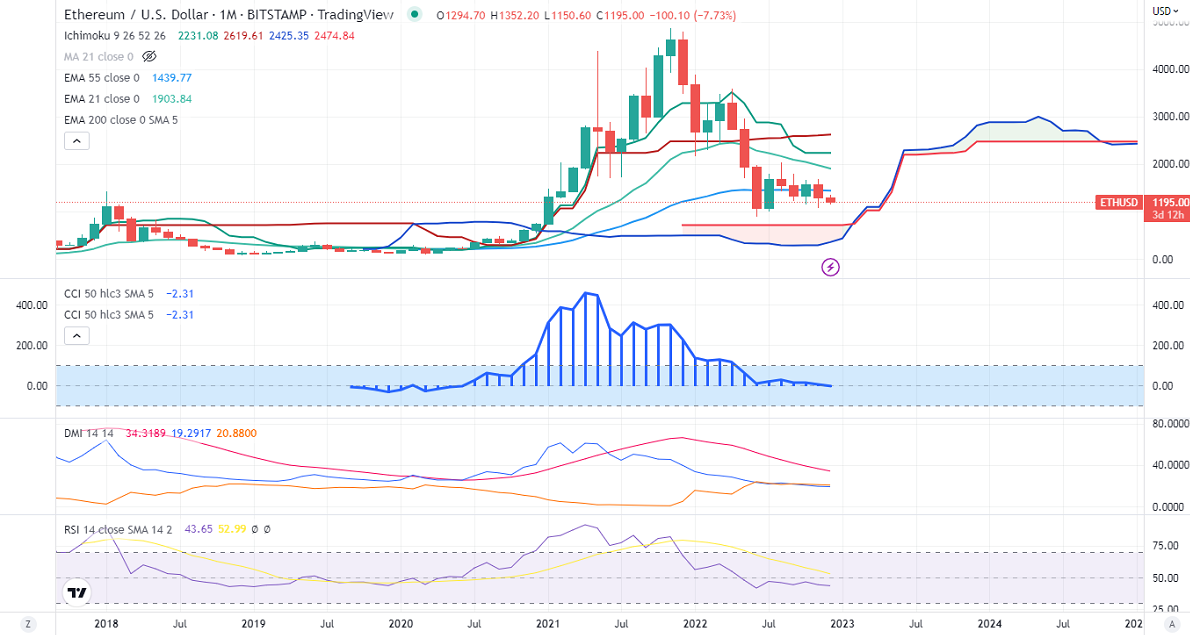

ETHUSD was one of the worst performers this year and lost more than $2500 on board-based crypto selling. A hawkish rate hike was a major reason for the decline of riskier assets like BTC. The collapse of FTX has dragged Ethereum further down. It hits a low of $880 on June 18th, 2022, and currently trading around $1196.10.

Major support - $880. Any violation below this level confirms major weakness. A dip till $830/$750.The pair holds below monthly Tenken-Sen ($2231) and Kijun-Sen ($2600). Any close below Ichimoku cloud ($750) confirms further bearishness.

A short-term trend reversal may happen if Ethereum closes above $1360. A jump to $1450/$1676 is possible.

Indicators (Monthly chart)

RSI- downtrend (45)

It is good to buy on dips around $850 with SL around $750 for TP of $2000

Resistance

R1- $1250

R2- $1360

R3- $1475

Support

S1- $880

S2- $750

S3- $600