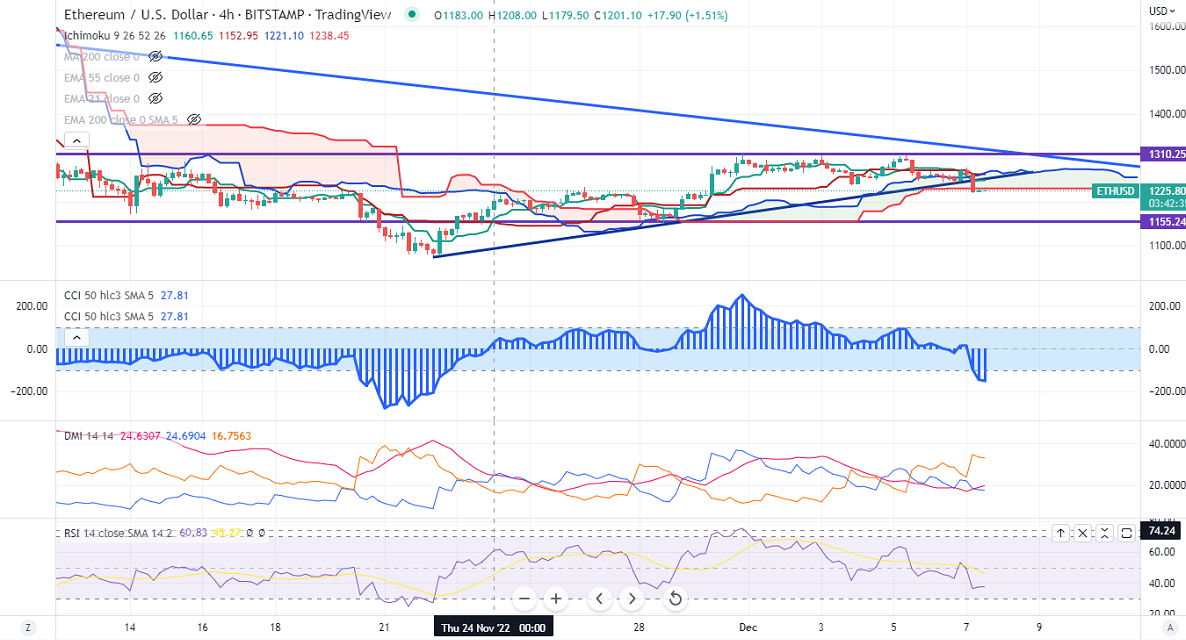

Double top $1300

Potential Reversal Zone- $832

Key Highlights

ETHUSD declined more than $500 after forming a double top around $1310. The pair formed a bottom around $1074 after the collapse of the FTX exchange. It hits a low of $1219.50 and currently trading around $1225.60.

It is trading well below the 4-hour Ichimoku Kumo cloud confirming the minor weak trend.

Major support - $1200. Any violation below this level confirms intraday weakness. A dip till $1070/$880/$830.

The pair holds below Tenken-Sen ($1248) and Kijun-Sen ($1262). Tenken-Sen crosses above Kijun-Sen in the daily chart show bulls are in control and better to wait and go short.

A short-term trend reversal may happen if Ethereum closes above $1310. A jump to $1375/ $1450/$1676 is possible.

Indicators (4-hour chart)

RSI- uptrend (above 35)

It is good to buy on dips around $1000 with SL around $800 for TP of $2000

Resistance

R1- $1310

R2- $1375

R3- $1450

Support

S1- $1200

S2- $1070

S3- $830