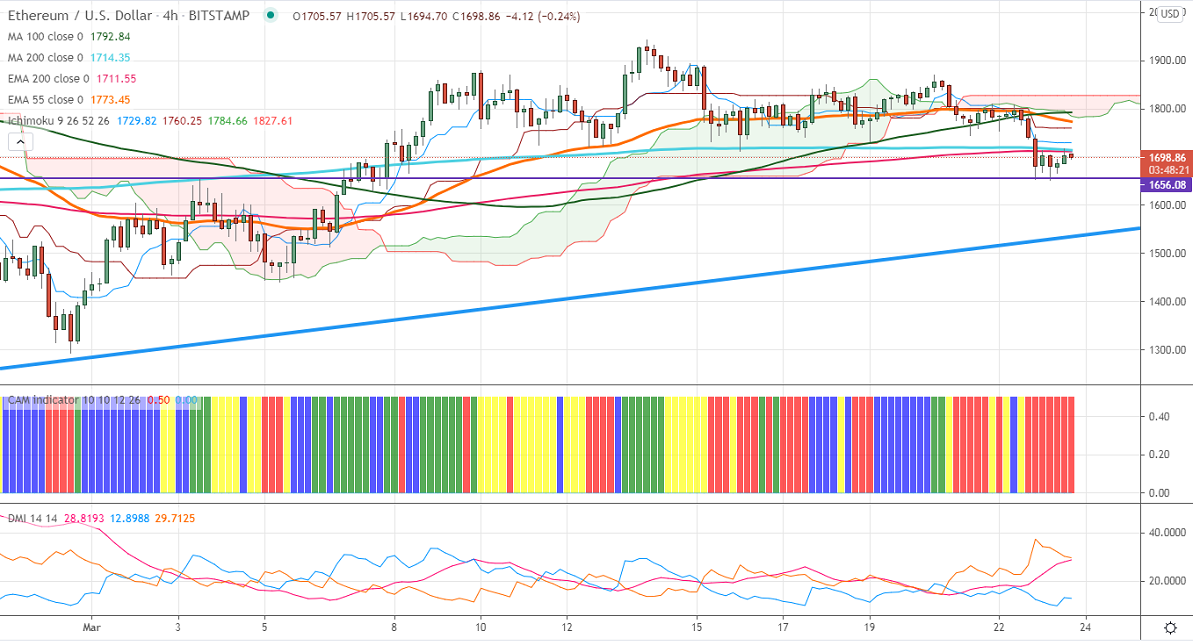

Ichimoku analysis (4-Hourly chart)

Tenken-Sen- 1729

Kijun-Sen- 1760

ETHUSD has halted its one week of the bearish trend and shown a minor jump of more than 4% from a low of $1651.09. The pair surged more than $1850 from a low of $125.55 made on Jan 3rd 202.0 Short term trend of this pair is bearish as long as resistance $2040 holds. It hits an intraday low of $1651.30 and is currently trading around $1706.50.

On the lower side, ETHUSD is facing strong support around $1650 and any violation below will drag the pair down to $1618 (55- day EMA)/$1540/$1490.

The near-term resistance is at $1720 (support turned into resistance), any indicative break above targets $1762/$1800/$1870.Significant trend continuation only above $2040.

Ichimoku Analysis- The pair is trading below Kijun-Sen, Tenken-Sen, and cloud. This confirms minor bullishness.

Indicator (4 Hour chart)

CAM indicator – Bearish

Directional movement index – Bearish

It is good to sell on rallies around $1735-40 with SL around $1805 for TP of $1550.