In BRICS FX bloc, ZAR weakness has probably run its course while the RUB benefited from the improving macro story in Russia and, more recently, from the firm recovery in oil prices with Brent bouncing above $55.

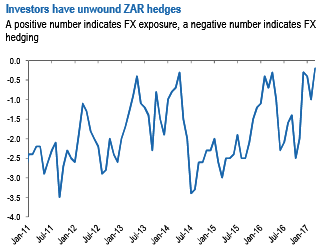

We expect USDZAR to settle around 13.5-14.00 in the days ahead as a base-case scenario. An overshoot is easily possible as investors have been increasing OWs and cutting FX hedges in recent weeks (refer above diagram).

We think a downgrade of local-currency ratings to junk is unlikely in the coming quarters. However, risks are that local-currency assets will not have much buffer against any policy deterioration going into 2018.

The HUF suffered the most in CEEMEA space, as the market discounted the sharply dovish stance of the MNB, which may use FX swap auctions to fine-tune liquidity and drive the currency lower.

In LatAm, the CLP strengthened the most, as other currencies remained pretty stable this week. The TWD and PHP took the lead in East Asia, benefiting from better US/China relations, Trump being vocal about the dollar being excessively strong, and boosted by a World Bank report raising the local forecast growth profile.

In Mexico, we still favor calendar skews and hold to our short-term view that more attractive carry-to-volatility ratios could drive speculative positioning to further correct, with USDMXN likely converging to the 18.2-18.6 range, all else equal.

We remain wary of both NAFTA negotiations and domestic political risk in H2’17, so we recommend positioning for near-term performance in MXN followed by a weaker H2 via 1m vanilla options. Next week, the Trump-Xi meeting could cast light of US trade strategy going forward, and could reverberate on USDMXN.

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate