EURUSD call spread EUR has struggled a little in the last few weeks with the weight of long positions together with the ECB’s fairly transparent attempts to shape market expectations for tapering so as to avoid any hawkish surprises and to minimize the risk of its very own taper tantrum. ECB President Draghi gives the opening speech at a conference on structural reforms in the Euro Area.

But at the same time, growth data in the region remains impressive and there would appear to be some upside risks to our 2% forecast for 3Q GDP with the nowcaster’s estimate having been bumped up to 2.5%.

In all, the data leaves us comfortable with core longs in EUR, albeit we recognize that a positive cyclical view of the region is now both consensus and positioned for and this should limit how far the euro can extend.

As for ECB in two weeks’ time, we suspect that market expectations are now clustered around an EUR 30-35bn expansion for nine months and that the reaction of the euro will depend on how close the ECB delivers to this. The reaction of the Bund market will probably be symmetrical, so 10bp lower in Bunds if the ECB goes to EUR40bn and 10bp lower if it opts for EUR 20bn. A 10bp move in Bund yields would translate to around 2-2.5 cents on EURUSD assuming no sympathetic change in UST yields, and perhaps 1-1.5 cents after allowing for this.

The core bias is for an eventual move down to the 1.15 region. The immediate stiff resistances are observed at 1.1810-1.1875, the supply sentiment is heavy between these areas, with a move back through there suggesting the correction phase from 1.1670 is ongoing, risking a test up towards 1.1950-1.20 before attempting another lower high. Near-term, momentum remains bearish at this stage, but we are mindful of intra-day support in the 1.1725/10 region, ahead of the lows.

This should see an eventual move back towards 1.30-1.35, but for now, we look for medium-term consolidation under 1.21-1.23.

Stay long in EURUSD through buying a 2m 1.1570 - 1.20 call spread. Paid 46bp on September 29th. Marked at -0.03%.

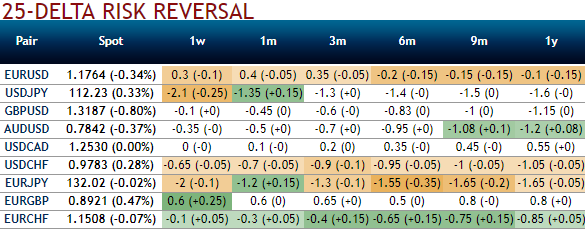

Most importantly, just glance through above nutshell evidencing the negative shift in risk reversals but with positive numbers that indicate the hedging sentiments for the upside risks. While positively skewed IVs signify hedging sentiments for the bullish risks.

Our call spread is in sync with the above OTC indications and is likely to participate in both short-term and medium-term swings.

Well, overall, the medium-term view on the euro remains bullish in anticipation of a pivot in ECB policy. EURUSD year-end forecast is at 1.20 and expected to be in a range in Q1 as Italian elections and possibly US-bullish factors dominate, but the September 2018 forecast is at 1.25as market focus shifts to the possibility of rate hikes. In the October meeting, we now expect the ECB to announce a slower but longer taper, specifically a 9month QE extension at €20bn per month versus our earlier expectation of a 6-month extension.

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data