In the euro area, the ECB minutes from the June meeting are set to be released today.

Policy meeting would be scoured for confirmation that officials are moving towards the further stimulus. The ECB pushed out its rates guidance to mid-2020 for the earliest increase, but President Mario Draghi revealed at the press conference that several members raised the possibility of rate cuts and a restart of QE. Recently, at a forum in Sintra, Draghi was more forthright in expressing his view that “further cuts in policy interest rates and mitigating measures to contain any side effects remain part of our tools.”

At the press conference, Draghi stressed that the governing council (GC) discussed several options at the meeting including a rate cut and a restart of QE. Draghi in his Sintra speech sent a strong signal to markets that more stimulus is coming. Hence, markets will look out for clues in the minutes on how ready the GC stands in announcing immediate steps already at the 25 July meeting. We still lean towards an announcement of an easing package coming in September. Earlier in the day, ECB's Coeuré will be speaking about 'Inflation expectations and the conduct of monetary policy'.

OTC Outlook:

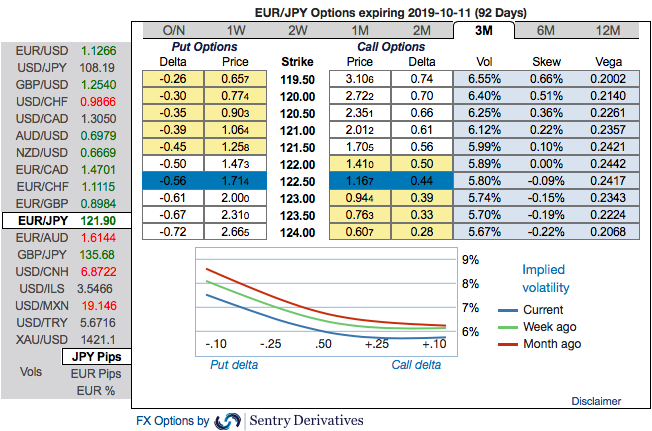

Hedging skewness (EURJPY): Please be noted that the positively skewed IVs of 3m tenors that are also signifying the hedging interests for the bearish risks. The bids for OTM puts of these tenors expect that the underlying spot FX likely to break below 119.50 levels so that OTM instruments would expire in-the-money.

Risk reversals Substantiate Skews (EURJPY): Most importantly, to substantiate the above indications, we could see some minor positive shifts in existing bearish risk reversal set-up of EURJPY that indicates the long-term hedging sentiments across all tenors are still substantiating bearish risks amid minor abrupt upswings in the short-term. Please be noted that 3m IVs are overall OTC barometer is a noteworthy size in the forex options market that can stimulate the underlying forex spot rate.

Options Trade Recommendation (EURJPY): We’ve advocated buying 3m EURJPY (1%) ITM -0.79 delta puts for aggressive bears on hedging grounds as the mild abrupt upswings were contemplated earlier.

Alternatively, we advocate shorts in futures contracts of mid-month tenors with a view to arresting potential dips. Source: Sentrix and Saxobank

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal