The speed of the correction in EM FX has surprised us, but we remain cautiously pro-carry in our region, given supportive valuations.

Among EM currencies, MXN vs. RUB is an interesting skew pair trade to consider.

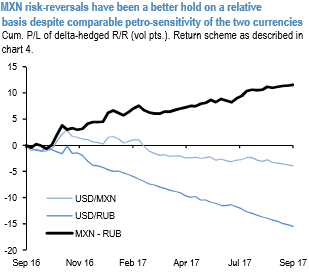

Neither has been individually profitable to hold from the long side, but the long/short RV has been a strong performer (refer above chart) and is relatively immune to gyrations in oil prices given the comparable petro-sensitivity of the two legs.

Current skew levels are favorable (3M 25D MXN RR @ 1.75 mid, RUB RR 3.1 mid; RR/ATM ratios 0.16 and 0.25 respectively), and JPM house views on the two currencies are aligned with the direction of the spread (U/W Mexico on NAFTA and heavy positioning grounds; O/W RUB on cheap valuations, carry and relatively clean spec positions).

The present combination of RUB FX and oil prices is quite favorable for the budget – RUB 3200- 3400 for Brent over the past week, i.e. on the high end of this year’s range – even if the significance of the gauge has diminished with the new budgetary rule in place.

Directional investors not given to active delta-hedging could consider long USD puts/RUB calls vs. short USD puts/MXN calls as a low management version of the skew RV. Courtesy: JPM

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary