The UK Secretary of State for Business said leaving the EU could cost British businesses £34.4 billion.

UK rates: UK bonds stopped to rally last night after the last poll gave a lead to the "Remain" camp but are still trading at the lows of the year at 1.28%.

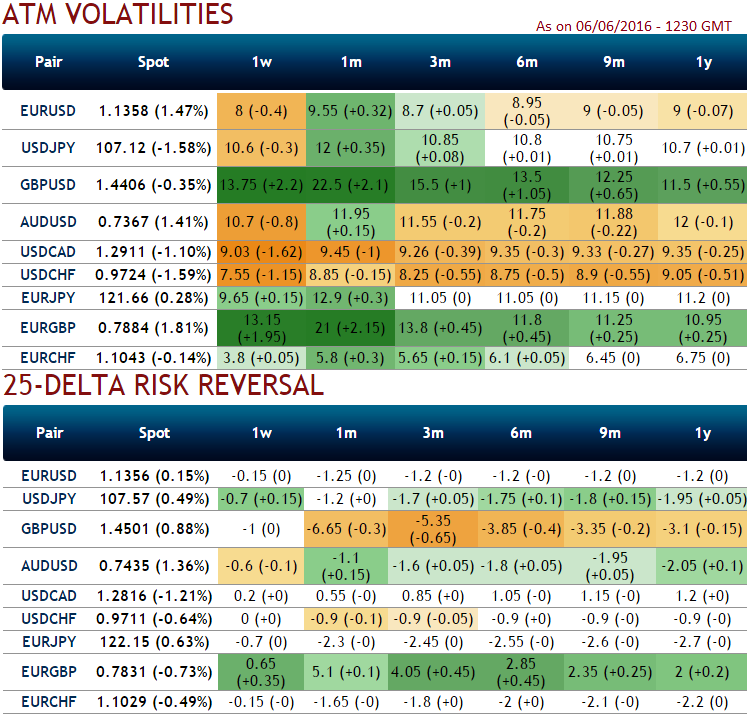

As a result, the FX option activities of GBP crosses have intensified, ATM GBPUSD IVs of 1m tenor have spiked above 22% with rising negative hedging sentiments. While euro’s gains against sterling are suggested by positive risk reversals.

The volatilities are still extremely bid in GBP with uncertainties still high surrounding the vote. The 1M continues to reach new highs at 22.2%.

25-delta risk reversals evidence the difference in volatility, and therefore price, between puts and calls on the most liquid out-of-the-money (OTM) options quoted on the OTC market.

The 3m is getting close again to the year high at 16. It is currently trading at 15.2, coming from a low of 12.5 a week ago.

The GBP managed to bounce from its strong support at the 100-day moving average to trade back in the middle of the range following yet another tight poll.

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data