The key UK economic data releases this week are the May PMI reports. The results of the Lloyds Business Barometer showed services activity lagging behind manufacturing. However, the manufacturing PMI release on Monday was disappointing. Meanwhile, the GfK consumer confidence survey rose to a seven-month high, aided by improving personal finances.

President Trump is making a state visit to the UK. Afterwards, PM May will stand down as Conservative Party leader on Friday. In the meantime, the Peterborough by-election (Thu) will be closely watched – in 2017, Labour won the seat with 48.1% of the vote and the Conservatives were a close second with 46.8%. If the European elections are any guide, support for the two main parties will probably fall.

Elsewhere, the Reserve Bank of Australia is the first major central bank of the G10 countries to cut its key rate, thus confirming the end of normalisation: this morning by 25bp to 1.25%. The rate cut had basically been announced, as Central Bank Governor Philip Lowe had signalled in a speech on 21st May that at its June meeting the Board would consider the case for lower interest rates. According to Lowe back then, the development in employment and inflation would be the main reasons. It could be that an even lower unemployment rate (currently 5%) was needed to exert upward pressure on inflation, according to Lowe back in May. After all, inflation disappointed in the first quarter with a decline to 1.3%, well below the inflation target of 2-3%. The reasoning remained unchanged in this morning’s statement. The market welcomes the RBA’s decision as the AUD is appreciating a bit. That illustrates: the market is demanding lower interest rates as a means of protecting against possible economic weakness. As a result, the pressure on the Fed to cut rates is mounting.

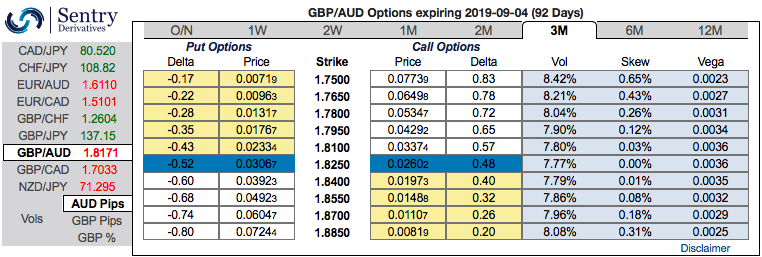

Hedging Framework:

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

The execution: Initiate long in GBPAUD 2M at the money delta put, long 2M at the money delta call and simultaneously, Short theta in 2W (1.5%) out of the money call with positive theta or closer to zero.

Rationale: Contemplating 3m IV skews that are well balanced on either side (positively skews on both OTM calls and OTM puts), we reckon that the Delta instruments are conducive to monitor directional risk so as to be aware that how much of option’s value would increase or diminish as the underlying market moves as this option tool measures the value of an option as the underlying spot FX moves. Well, ahigher (absolute) Delta value is desirable on long leg in the above stated strategy. Whereas, the Theta is positive on short leg; as the time decay is good for an option writer (that’s why we’ve chosen narrowed expiry).

We reiterate, in the prevailing puzzled environment you could observe that the momentary bulls of GBPAUD has currently been trading in non-directionally but with some bearish pressures. Hence, we advocate the above hedging strategy with cost effectiveness that could hedge regardless of the swings on either side. Courtesy: Sentry, Lloyds & Commerzbank

Let’s now quickly glance at the FxWirePro’s Currency Strength Index: Hourly AUD spot index is flashing 43 (which is mildly bullish), while hourly GBP spot index was at shy above -84 (bearish) at 13:02 GMT.

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist