We uphold long in NOKSEK in the spot and in option forms as Norway continues to deliver better news with the underlying message being that activity data is improving and inflation is firming, which in combination with a lower inflation target should make the Norges Bank more amenable to a September rate hike. The message on stronger activity data was highlighted by the quarterly regional network this week which was constructive with broad-based improvement in tone, with the forward-looking component suggesting that GDP growth is set to increase to 3%ar by mid-year.

On inflation, CPI was firmer than consensus, but in line with Norges Bank’s forecast on the headline. Underlying inflation was indeed 0.3%pt below NB’s forecast but this was also the case in January, but our economists note that this didn’t trigger discomfort among the Executive Board members.

The Norges Bank meeting next week will be key next week. We are looking for them to revise the rate path too show an earlier start of rate hikes (a small probability for 3Q) without a change in the steepness of the curve. The currency is close to NB’s December forecasts so that NOK has been the outperformer in G10 since the beginning of the year should not be a source of concern.

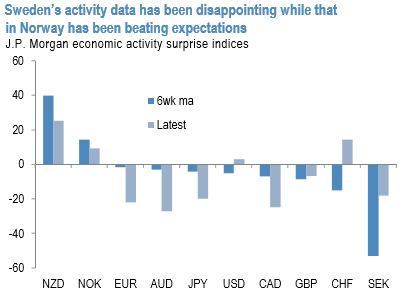

Our preference is to hold NOK longs tactically vs. SEK. While the medium-term view is constructive on SEK as well, the expectation is that the Norges Bank policy is more influx in the near-term which should result in a mean reversion in FX valuations. Moreover, the tactical cyclical backdrop is more favorable of NOK than of SEK with the 6-week moving average of our EASIs the most negative for SEK (refer above chart) but among the highest for NOK in G10.

Buy a 3m NOKSEK 1.066/1.092 call spread vs EURSEK 9.95 put for a net 20bp. (Spot refs 1.0606 and 10.0856).

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand