ECB President Mario Draghi will also be speaking in Jackson Hole – and before that in Lindau, Germany. The FX market will mainly want him to say whether the euro strength seen over the past months is beginning to get too much for him. That is what the European central bankers had expressed in the wording of their meeting minutes. If Draghi does not say anything on the matter this could be seen as an attempt to back paddle, strengthening the euro further. That would not be in the interest of the ECB head his speeches.

Nevertheless, his speeches are always partly contextual. In particular in Jackson Hole – usually, a good place for fundamental strategic comments – an obvious verbal intervention against euro strength would not be appropriate, as representatives of all central banks will be present who have promised each other not to manipulate exchange rates – not even verbally.

We already pronounced that the view of front-end vols will stay well-supported as August, in general, tends to be a seasonally strong month for volatility, and the investors seem inadequately invested in the bullish Euro trend judging from the breadth and intensity of spot rallies and counter-conventional spot-vol correlations so far, so directional option demand is likely to remain robust, as per the JP Morgan’s stances.

The Kansas Fed’s August 24th - 26th Jackson Hole conference where Mario Draghi is slated to speak two weeks before the September 7th ECB meeting will provide a natural magnet for such option flows, as investors sniff for hints around the ECB’s tapering intentions. 1-month option expiries rolled over the Jackson Hole dates this week, and 1M ATMs in Euro-and Euro-crosses have jumped to reflect the elevated day-weight (21% O/N vol) being assigned to the event.

Despite the repricing in option prices over the past few weeks, we see a couple of option opportunities that still offer value around the bullish Euro theme:

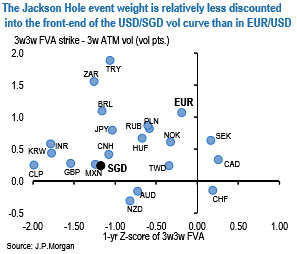

Judging whether the Jackson Hole event weight is excessive for a single currency is tricky, but it is easier to identify vol curves where this risk premium is underpriced relative to EURUSD. Using the slope of the 3-wk/6-wk ATM (pre-Jackson Hole vs. post ECB/Fed) curve as a proxy for the event risk premium, USDSGD stands out as an underpriced candidate that has tracked EURUSD with 60% correlation in spot returns over the past month –not surprising given the ~13% JPM-estimated weight of EUR in the SGD basket - and where forward vol is both low on levels and almost flat to spot ATM (refer above chart).

As a bearish dollar play with a positive carry lean, short 3-wk vs. long 6-wk 1.3450 strike USD put/SGD call one-touch option calendars are well priced ~20% (1.3610 spot) and accrue smalls positively (~1.3X) in premium on a static basis, which can be monetized if SGD remains sandwiched between offsets of broad dollar weakness and richness within the SGD NEER band (+88bp at the time of writing) over the next month until given a move on by Dr. Draghi.

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts