The RBNZ was very dovish at the May MPS. Despite inflation recovering in 1Q to above 2%oya for the first time in six years, Governor Wheeler stuck to his neutral guidance, and the staff maintained their forecast that the OCR would not rise until 3Q19. This has badly wrong-footed a rate market that pricing a significant chance of a hike by year-end.

The Governor describes the recent upside in inflation as tradable - driven and “temporary”, and at a more existential level, sees broader “inflation risk” as low, given that wages have been so benign and expectations are well-anchored. NZD should, therefore, be at the mercy of a reappraisal of the outlook for real short rates, particularly relative to the USD in 2017.

We expect NZD to fall through this year, reaching USD0.63 at year-end. The support to growth from migration will fade, while the RBNZ are showing commitment to holding rates steady, even as inflation has normalized, pushing real rates materially lower.

The economy is also now subject to credit tightening through numerous channels: macro-prudential constraints, regulatory initiatives, widening mortgage rate spreads, and banks’ discretionary tightening of credit criteria to businesses. While we expect the RBNZ to be on hold, there is a clear downside risk to the OCR if the correction in housing is sharper than expected.

Growth has weakened lately. GDP growth was 0.4% QoQ in the three months to December, a weaker than expected outcome. 3Q GDP was also revised down too, leaving “output growth in 2H16 weaker than had been expected” by the RBNZ, as noted in the May Monetary Policy Statement.

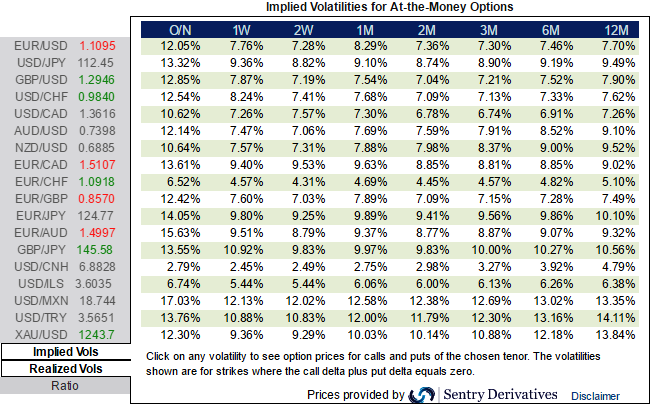

Please be noted that the ATM IVs of the pair has been quite below 7.9% and a tad below 8.4% for 1 and 3m tenors respectively. Skews have been still indicating the hedgers’ interests in downside risks.

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch