First and foremost thing that we want to emphasize is that the momentum remains negative for this pair, we reckon the next bearish target to hit 1.0235 levels (Sept’16 low).

AUDNZD 1-3 month: Foresee potential below 1.0350 upto 1.0235 levels in medium terms. Higher to 1.0425, mainly for valuation reasons. The cross remains well below fair value estimates implied by interest rates, commodity prices, and risk sentiment. However, we acknowledge Australia’s AAA downgrade risk, any such action likely to delay any return towards fair value during the next few months.

OTC updates and hedging Framework:

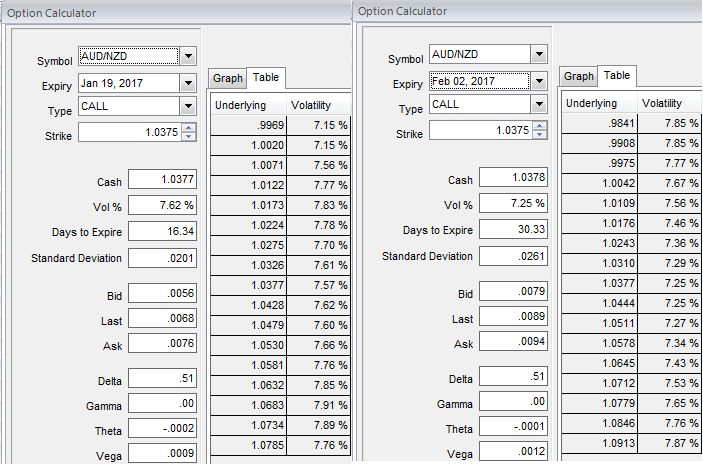

Please be noted that the implied volatility of at the money contracts of this APAC pair has been dropped below 7.5% for 2w expiry and shy above 7.6% for 1m tenors, while 1m vega are signifying the hedgers’ interests in downside risks.

So, the speculators and hedgers for bearish risks are advised to optimally utilize the upswings in short run as the lower implied vols are conducive for option writers.

With GDT index and Aussie trade balance lined up for the announcement that are the major data focus for this week.

Hence, AUDNZD's lower IVs with vega’s interest on OTM put strikes could be interpreted as the option holder’s opportunity in the medium run.

Weighing up above aspects, we eye on loading up with fresh longs for long-term hedging, more number of longs comprising of ATM instruments and ITM shorts in short term would optimize the strategy.

So, the execution of hedging positions goes this way:

Short 2w (1.5%) ITM put option as the underlying spot likely to spike mildly, simultaneously, go long in 1 lot of long in 1m ATM +0.49 delta put options and 1 lot of (1%) OTM -0.37 delta put of 2m expiry.

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed