US dollar appreciates versus EM & DM currencies as EM spillover concerns rise. US Treasuries bear steepen as corporate supply picks up. Effective fed funds rate declines 1bp, to 1.91%. US 10y rises 3.8bp, to 2.90%. The US dollar dominates international transactions not because companies are forced to use it, but because it is efficient. Nevertheless, that does not mean that Juncker has to forget about his dream. In fact, a movement away from the US dollar and towards the euro has already been taking place for some time now.

The season has changed, but market themes have not. Because of the dollar’s robustness, EMFX suffered its third worst month since the global financial crisis and this weakness has extended into fall. This stands out in two other key ways:

Primarily, the fact that EM FX weakness accelerated in August in absence of broader USD strength or higher US yields.

Secondarily, growing spillover from individual hotspots into broader EM FX.

While Euro vol is more sensitive to the ebb and flow of Italy headlines, JPY is more levered to contagion from an escalation of trade tensions.

Even absent these risks, there are good reasons for directional yen ownership – structural under-valuation, susceptibility to hawkish BoJ policy tweaks, political imperative for lower USDJPY amid US – Japan trade negotiations and the unwind potential of retail Japanese EM investments – that can push USDJPY towards 107 by year-end.

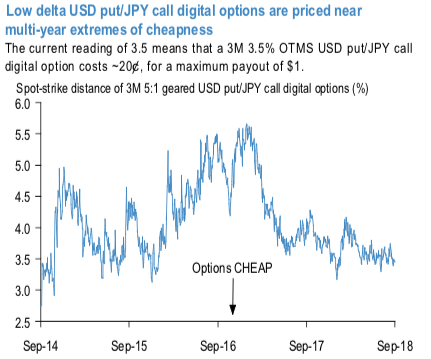

The combination of low vol and elevated risk-reversal/ATM ratio means that USD put/JPY call spreads/digitals are inexpensively priced near 4-yr lows (refer above chart).

We recommend: Off spot ref. 111.50, buy 3M 107 strike USD put/JPY call at-expiry digitals @ 14.75%/15.75% USD indic. Digital / spread structures, as opposed to outright USD puts, are in deference to reasonably high risk-reversals, the ongoing softness in realized vol, and the persistent nature of Japanese outflows this year that have dampened yen’s traditional risk beta.

This has coincided with a period of S&P 500 strength but can turn if the latter were to come under pressure after the new round of trade sanctions. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly JPY spot index is inching towards 176 levels (which is bullish), USD at -71 (bearish), while articulating (at 09:37 GMT). For more details on the index, please refer below weblink:

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts