The USD continues to spikes to five-week highs against its Canadian counterpart today as well, CAD has been appearing to be weaker since the release of downbeat Canadian economic growth data and as expectations for the U.S. rate hikes next year continued to support the greenback. But the only booster for CAD is that crude trading comfortably well above $53 levels with healthy further bullish sentiments.

The trend for this pair appears to be puzzling as dollar’s bull trend is backed by FED’s hawkish rhetoric and CAD is cushioned by crude’s gains.

You hedge this pair whether for bullish or bearish risks, at-the-money options that have a delta of approximately positive/negative 0.50 or 50% (for puts -50%) seems more conducive, we explain how. What and how does 50% delta mean?

Well, this means that if the spot market moves .0100, the option value will change half as fast, or about .0050. Since options can often cost less in cash that the amount of a spot margin, these trades can produce a rate-of-return much greater than spot trading. This is especially true for slightly out-of-the-money options.

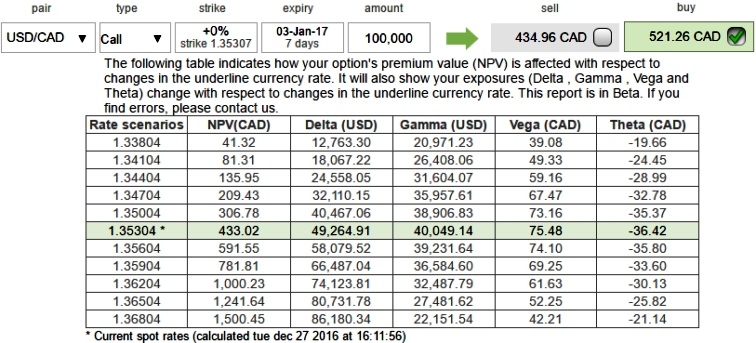

For an instance, let’s ponder 1w ATM call of USDCAD as shown in the diagram:

The pair in spot FX market is trading at 1.3530. At 10% volatility, 7-day at the money call options are worth CAD 521.26, if the contract size is 100,000 and just suppose the margin rate is 2%, then a spot margin will be .02 * 100,000 * 1.3530 = $2,706.

Let’s assume with 10% implied volatility, the ATM call option costing us about CAD 521.26 to buy the same units of currencies.

One week from now, what if the spot market has moved up to 1.36 (i.e. just 0.51%), the call option (on expiry) would now be worth CAD 1042.34 and the long spot trade would have made for the same 100,000 units is about CAD 700 (i.e 100,000*1.36 – 100,000 * 1.353 = 700), let’s now compare this with option yield. Trust us, you would be amazed, option payoff is CAD 1042.34 (almost close 100% returns).

Long options offer traders an exceptional amount of leverage for directional trades, especially for short-term time horizons.

Option purchases (buying a call or buying a put) are often cited as attractive trading strategies for directional trades because of the limited loss associated with being an option holder. The premium paid for the option is the total amount than can be lost in the trade. Similarly, the profit potential for option holders is enormous if the underlying market makes a big move higher (in the case of calls) or lower (in the case of puts).

What is often overlooked, however, is another property of these trades that can make them look even more attractive: Leverage. Under many circumstances, long option positions can produce a much greater rate-of-return on margin money than can outright spot trades.

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data