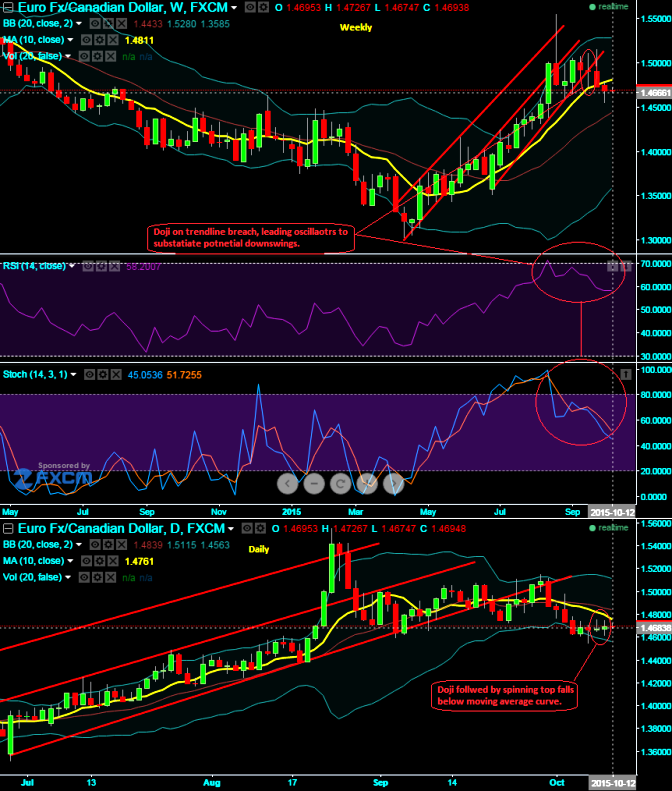

On both weekly and daily charts of EURCAD we spot out Doji pattern candles formed to highlight a caution for bulls. As you can observe Doji on weekly charts has occurred exactly on a trendline breach at around 1.4909 levels which is to be considered as a caution of previous of upswings. On daily chart, again a sharp Doji is formed at 1.4674 levels followed by a spinning top candle has formed to fall below moving average curve.

In addition to that leading oscillators are showing convergence with the price dips on weekly chart. RSI (14) looks healthily converging with every price declines at 58.3084; it has been showing the same indication right from overbought territory. So, RSI signifies the prevailing down streaks may sustain for some slumps.

While another leading oscillator (slow stochastic) hints us the overbought heaviness through %D crossover above 80 levels which overbought zone though the bulls don't seem to lose rallies built by healthy volumes.

Hence, the trading recommendation would be good to buy binary puts on every rally for targets at 20-30 pips.

FxWirePro: Doji on trendline breach hints EUR/CAD bearish sentiments – expect further slumps

Monday, October 12, 2015 8:11 AM UTC

Editor's Picks

- Market Data

Most Popular

5

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings