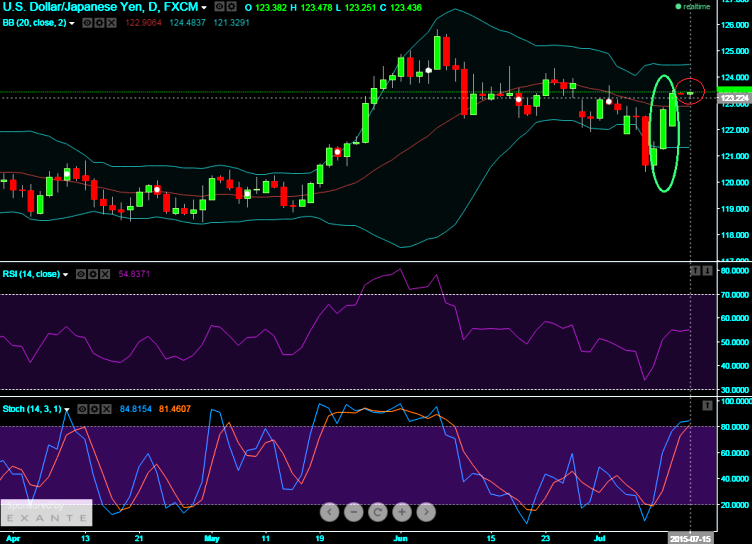

Intraday trend seems sideways as Relative Strength Index converging according to price fluctuations and but looks a slightly weaker as %D line crossover on slow stochastic.

On EOD charts, the formation of four priced doji candlestick pattern occurred at 123.382 levels that reflects the highest extent of indecision between bulls and bears as there was also 3 white soldier pattern occurred before.

For today, one can see shorting opportunity in straddle constructed by ATM instruments as the pair is puzzling around on either sides during intraday sessions.

So for intraday position we look at shorting 1D slightly above ATM calls (maybe 0.10%) and slightly below ATM puts (maybe -0.10%) with positive theta value for a net credit. Position has to be squared off during US trading session.

Maximum returns for this option combination is achieved when the USDJPY on expiry is lingering at the exercise price of the options sold which means underlying exchange rate should not make much fluctuations on either sides.

FxWirePro: Doji forms on USD/JPY; certain yields on short straddle

Wednesday, July 15, 2015 5:38 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary