Swiss in focus: option structures for the SNB monetary policy shift

Since the ECB and BOC's hawkish turns last year’, investors have been scouring for signs of the next G10 central bank to tighten policy.

Does SNB need to lag the ECB: The SNB is expected to hold monetary policy steady through 1H’18, thus allowing the ECB to lead the way on policy normalization? Such a stance is necessary to keep the EURCHF exchange rate on an upward trajectory. Similar to the fitful climb in Swiss inflation, the EURCHF’s climb likely will be a sporadic one.

Despite the SNB’s claim that the franc is overvalued, the Swiss current account surplus has been stable at an elevated level for several years. The US government has raised pressure on Switzerland over the persistent surplus and its foreign exchange interventions.

Although Switzerland is not pursuing a weak currency policy, the persistent external surplus is a key counterpoint to any claim that the franc is overvalued.

Judging from recent ructions in short-dated CHF options, SNB appears to have registered on investors' radar as a possible candidate given the sharp slowdown in FX intervention and balance sheet expansion since last May.

Expectations for a re-orientation of SNB policy have started gaining traction as evident from the 1.5 pt. jump in 1M ATM vol over the last two weeks.

Last week, our macro strategists opened a short USDCHF cash position as a triple play on short USD, long Europe and a gradual SNB shift (Sell USDCHF); in this section, we discuss option opportunities that can supplement cash franc longs.

Options structures:

USD put/CHF call spreads and/or RKOs: Owning standalone OTM USD puts/CHF calls is an onerous proposition due to the triple whammy of negative carry on points, the recent surge in short-dated vol and steep risk-reversals.

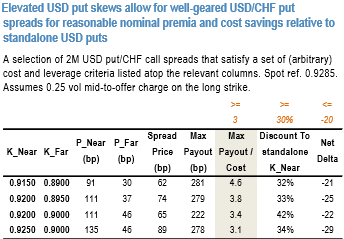

While riskies in most USD-majors have re-shaped in the direction of USD puts as the broad dollar has weakened, USDCHF is one of the most extreme examples of elevated USD put skews, which in turn results in one of the highest leverage ratios on USD put/CHF call spreads in recent memory (refer above chart). Courtesy: JPM

At current market (spot ref. 0.9250), a 2M USDCHF put 0.92 /0.90 USD put/CHF call spread costs 65bp, offers 3.4x max gearing and 40%+ cost savings relative to the standalone 0.92 strike vanilla call (refer above nutshell for a selection of USDCHF put spreads with decent optics).

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close