Before we begin with this write up let’s just have a glimpse through EMFX: We stay OW EM FX. In EMEA EM, we diversify long RUB and TRY with short ZAR, and hold OW CZK vs. UW RON. In LATAM, we recently rotated out of OW CLP into OW PEN, and hold OW BRL vs UW MXN. In EM Asia, we hold OW MYR and short USDSGD.

KRW: Absent a severe escalation of hostilities, the downtrend in EM volatility should drag KRW vol lower and the recent range (1113/1159) should hold. Selling volatility and fading the spike in skew through limited loss structures (i.e. DNT’s) could be appropriate.

CNH: The PBoC’s comfort level with RMB appreciation seems to be waning and they may not want a move below 6.50. Topside exposure coupled with selling a downside strike (i.e. bullish seagulls) could be an appropriate structure, especially if an EM correction unfolds.

RUB: RUB-oil model indicates fair value around 61 and CBR easing could weigh on the ruble aggressive. Given the fundamental view and vol parameters (low skew, vol, and convexity coupled with a decent vol-spot beta), a simple vanilla call in the gamma bucket (1-3m) could be considered.

In a nutshell:

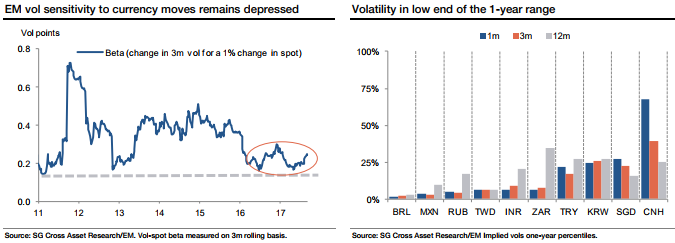

Levels vs history: Implied vol remains at the low end of its one-year range, while the gap between implied and realised vols is in the upper end of the range as realised vol even more depressed.

Vol and skew beta: The sensitivity of average EM implied vol and risk reversals to changes in underlying spot rates remains depressed near five-year lows (exception being BRL).

Value: Based on the position of volatility to its one-year range and carry costs, volatility is cheap in most EM currencies, particularly the MXN, RUB, ZAR, PLN and CZK.

Skew: KRW has high skew and high skew-to-vol (call spreads offer attractive discounting for dollar bullish views) – these metrics are very low in CNH and SGD.

Convexity: Butterflies are expensive in KRW and cheap in CNH, TWD, INR, in our view. Courtesy: SG

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics