The recent developments in the Swiss franc have been less intense over the past month than in the latter part of July when the surge in EURCHF fuelled an expectation in certain quarters that the franc was on the cusp of a material downgrade against a resurgent euro.

SNB is scheduled for its Libor rate announcement on Thursday and you can foresee bearish scenarios of CHF given the fact that SNB resumes FX intervention at higher spot rates than previously and can be bullish if SNB desists from intervention over a multi-month period. Potential trigger events are SNB intervention (weekly sight depos, monthly stats, P&L on Swiss reserves).

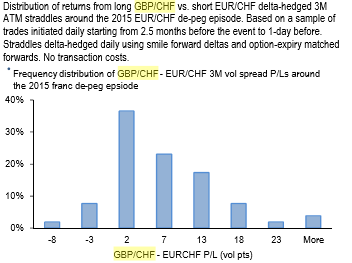

The above chart demonstrates that GBPCHF - EURCHF vol spread returns are reasonably well insulated to SNB shenanigans: the P/L distribution of such trades initiated in the weeks before the 2015 franc de-peg has a positive mean (2 vol pts.) and appreciable positive skewness.

The complexities of CHF vols have hopped recently following the sharp rallies of EURCHF spot, and prolonged to hold in well around local highs even as the uptrend in EURCHF took a breather this week.

A plausible reason for this stickiness of implied vols even as realized vols have started to cool (hourly 1-wk realized 8.3, 4-wk 9.8) is that they are not yet convincingly below short-dated ATMs (1M 8.3), and demand for EURCHF gamma can be justified so long as geopolitical jitters preserve the possibility of a sharp spot reversal to whence the rally started from.

Another reason is that the community of CHF-vol sellers has become extinct after the franc de-peg episode of 2015; CHF-vol recommendations these days beget disinterest from clients due to a combination of de-peg PTSD and draconian risk management restrictions put in place after the event.

The CHF vols and correlations have soared following the recent spike in EURCHF and JP Morgan reckons that the flipside of this, lack of participation is the availability of RV opportunities in the CHFCHF-cross option space, few trades are highlighted as below:

Buy GBPCHF – EURCHF vol spreads, bid USDCHF 3M3M FVAs and dual digitals as a low premium risk hedge in GBPCHF, CHFJPY and AUDCHF, CHFJPY. We would discuss more in detail in our upcoming posts on these trades to shed more lights on this. Courtesy: JP Morgan

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic