Inflation in Poland has refused to accelerate through this upswing. We imagined that the April core inflation reading of 0.6% YoY was low enough to establish the point. But, the Inflation rate in Poland edged up to 1.7% in May of 2018 from 1.6% in April, matching the preliminary estimate. It was the highest inflation rate since January, as prices rose faster mainly for fuels for personal transport equipment (9% vs 1.3% in April), the May CPI breakdown published yesterday indicates that core inflation could have dipped even further to 0.5% YoY in May (data due today).

If this proves correct, it would mean that for some time at least, the Polish inflation outlook will appear even more dovish than the Hungarian one.

With this, the MPC doves are likely to regain their upper-hand after losing their position somewhat when euro zone inflation data accelerated during May.

We moved MW on euro area weakness. We recently reactivated our bullish PLN position following disappointing euro area business surveys and further EURUSD downside. Fundamentally, we remain constructive, believing the currency is now relatively weak compared to the resilient domestic data. However, the scope for meaningful appreciation will remain limited until EURUSD turns higher, in our view. EURPLN has slid from the highs of 4.3407 levels to the current 4.2829 levels from 2 and a half months and we anticipate the bearish run to continue further.

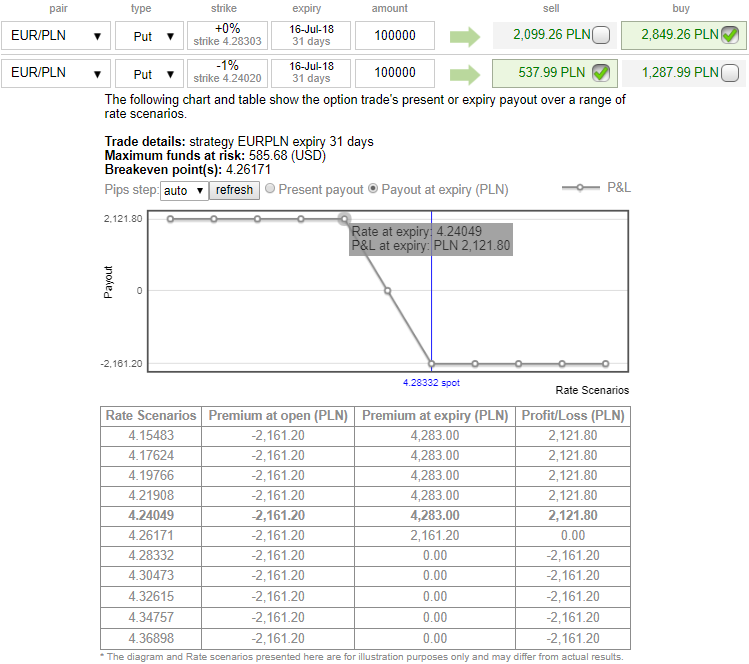

Hence, as shown in the diagram, one can deploy debit put spreads with a view to arresting potential bearish risks.

The execution is shown in the above diagram, one can initiate longs in 1M ATM -0.49 delta Put + Short 1m (1%) OTM Put with lower Strike Price with net delta should be at -0.16. Please be noted that the positive payoff structure would be generated as it keeps dipping below current levels but remain within OT strikes.

For a net debit, bear put spread reduces the cost of trade by the premium collected (on the shorts of OTM put) and keeps option trader to participate in downward moves and any upswings in abrupt.

Moreover, the risk is capped to the extent of initial premium paid, as opposed to unlimited risk when short selling the underlying outright.

However, put options have a limited lifespan. If the underlying FX price does not move below the strike price before the option expiration date, the put option will expire worthless.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures