Before describing the Vega longs, let’s begin with volatility.

The volatility of any asset price (currency pair in this case) is simply how much it fluctuates with no regard to direction. It is given as a percentage of the asset price. A higher volatility means the price has moved or is expected to move over a larger range in a set time period.

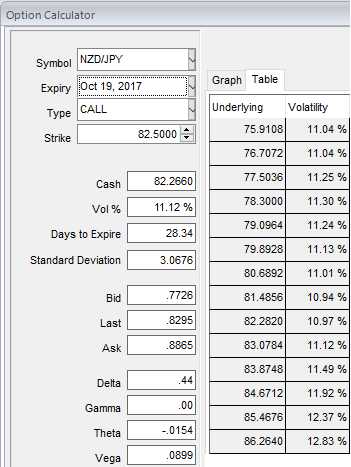

Please be noted that the call options of 1m tenors of NZDJPY is trending higher at 11.12%.

Future volatility is the volatility of the underlying price over some period in the future. The price of an option depends on future volatility, yet it is impossible for anyone to know exact future volatility. However, it is possible to calculate the market place’s expected future volatility using the option’s price itself. This is known as implied volatility (IV).

Vega longs are contemplated in this strategy as it measures the sensitivity of an option’s value to a change in volatility. It is usually expressed as the change in premium value per 1% change in implied volatility.

Please also be noted that the options with a higher IV cost more which is why in this case OTM puts have been preferred over ATM instruments. This is intuitive due to the higher likelihood of the market ‘swinging’ in your favour. If IV increases and you are holding an option, this is good.

The RBNZ has signaled the next cycle – a tightening one – would not begin until the end of 2019. That will anchor the short end, although markets will not abandon their expectations for tightening as early as mid-2018 which means occasional spikes in the 2yr swap rates will be likely.

Well, in order to arrest this upside risk that is lingering in intermediate trend and prevailing declining trend, we recommend diagonal option strap versus OTM put strategy that favors underlying spot’s upside bias in long run and mitigates bearish risks in short term.

So, we recommend building the FX portfolio exposed to this pair with longs positions in 2 lots of 1M ATM 0.51 delta calls and 1 lot of ATM -0.49 delta puts of same expiries, the strategy is constructed at net delta of 50% as shown in the diagram.

This NZDJPY strategy should take care of both upswings and downswings simultaneously, and on speculative grounds the strategy is likely to derive handsome returns on the upside and certain yields regardless of swings on either side but with more potential on upside.

Straps are unlimited returns and the limited risk options trading strategies that are used when the options trader ponders over the underlying spot price would sense significant volatility in the near term and is more likely to rally upwards instead of plunging downwards.

Currency Strength Index: FxWirePro's hourly NZD spot index is flashing at 57 levels (bullish), while hourly JPY spot index was at shy above -45 (bearish) while articulating at 06:17 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data