Ahead of the ECB meeting on Thursday, we have to get the latest PMI readings across the Eurozone. Economic data slumped in Q1, but while a level of recovery has been witnessed in Q2. However, ECB policy has proved a modest disappointment for EUR as the last meeting deferred a hike until at least autumn 2019 even as QE is set to end this December.

Already it is clear that not all ECB members are comfortable with its calendar-based guidance, and we would expect ECB rhetoric to evolve in a less dovish fashion assuming that the economy can get back on track, and stay there. Trade conflict is, of course, a risk to this benign economic scenario

While on a broader perspective, EUR is starting to stabilize following the succession of economic and political shocks that triggered the abrupt depreciation from late April. EURAUD at 1.5805 levels, is stuck in the long lasting range as the major trend persists (refer monthly plotting). Technically, the hanging man pops up at peaks of rallies of the pair coupled with the overbought signal by leading oscillators, which means as the weakness prolongs that likely to bring this pair back into the range.

OTC outlook and Options Strategy:

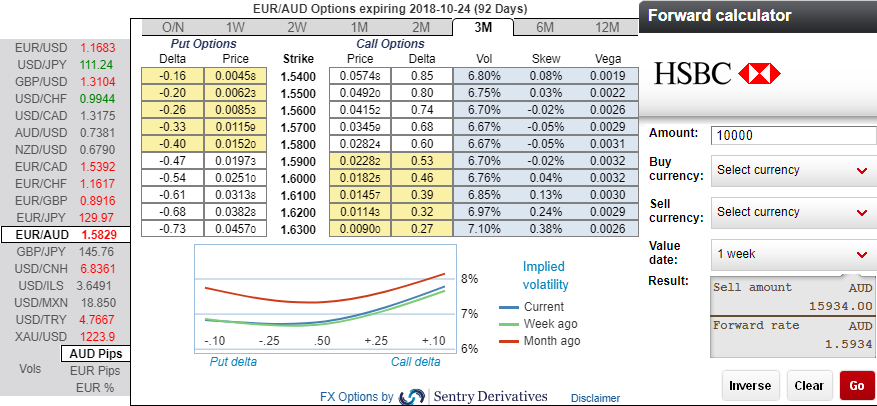

Most importantly, please be noted that IV skews of EURAUD are stretched on either side, but the positively skewed IVs of 3m tenors are signifying more hedging interests in the bullish risks. The bids for OTM puts of this tenor indicate that the underlying spot FX likely to spike upto 1.63 levels so that OTM puts would expire in-the-money. Forward rates of 3m tenors are also substantiating the bullish risks.

Contemplating fundamental, technical and OTC factors, it is sensed that all chances of the Aussie dollar may look superior over Euro in medium-term future; we advise to hedge the Euro’s depreciation over AUD through below recommendations.

We’ve been firm to hold on this strategy on both trading as well as hedging grounds, unlike spreads, combinations allow adding both calls and puts at a time in our strategy.

Buy 1m At-The-Money delta put option and simultaneously buy 2 lots of At-The-Money call options of similar expiries.

It involves buying a number of ATM puts and double the number of calls. The option strap is more of customized version combination and more bullish version of the common straddle.

Huge profits achievable with the strap strategy when the underlying currency exchange rate makes a strong move either upwards or downwards at expiration, with greater gains to be made with an upward move.

Hence, any hedger or trader who believes the underlying currency is more likely to spike upside can go for this strategy. Cost of hedging would be Net Premium Paid + brokerage/commission paid.

Currency Strength Index: FxWirePro's hourly EUR spot index has shown 35 (which is bullish), while AUD is flashing at 32 (bullish) while articulating at 11:08 GMT.

For more details on the index, please refer below weblink:

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan