Options Strategy: (XAU/USD) Diagonal call spread

For current technical situation as explained our earlier post, this strategy can be employed to hedge the FX commodity exposure.

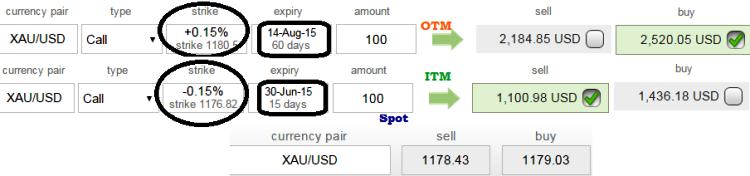

On hedging grounds, We recommend buying 60D (far month) 0.15% Out-Of-The-Money carrying 0.5 delta call (strike at 1180.19) and simultaneously short 15D (near month) 0.15% In-The-Money call (strike at 1172.33) with positive theta value.

As you can observe on the above diagrammatic representation of this strategy, almost upto 50% of the cost is flowing in through short term (15D) ITM instrument.

But always have this in mind that the shorting instruments with +ve theta to be analyzed with other option Greeks during selection of such short side options.

FxWirePro: Deploy Diagonal Call Spread on Falling Wedge

Monday, June 15, 2015 9:01 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary