The old conflict between what the market expects and what the Fed suggests has been re-ignited. This does not involve a rate hike expected for today which is completely priced in on the market and which therefore constitutes a non-event.

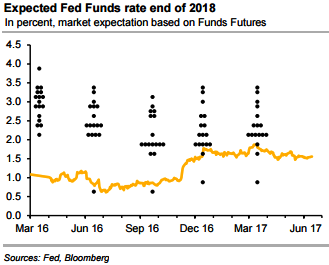

So, what is decisive for USD is the monetary policy outlook beyond today. And that is what Fed and market do not agree on, as the rate expectations until late 2018 illustrate (refer above chart).

Over and beyond today’s 25bp rate hike the Fed expects four further rate steps until the end of next year, the market only one or two.

DXY (US dollar index) which measures the greenback’s strength against a trade-weighted basket of six major currencies, was steady at 96.99. It has been trading in the choppy range from the last couple of days, having no proper direction of the trend with slightly bearish bias.

Ahead of today’s FOMC’s decision on funds rates, although we could see some sort of bearish sensation but the swings could go in either direction with the major trend goes in consolidation phase. Hence, the recommendation goes this way:

Initiate long in 2w ATM +0.51 delta call, and simultaneously buy ATM -0.49 delta put of the same tenor for net debit.

Well, this option trading strategy that is used when the options trader ponders that the underlying gold prices would experience significant volatility but not sure of the direction of the swings.

The overnight volatility has two readings, which are necessary and complementary to read risk event premiums. The directional purpose is related to the straddle breakeven, while the volatility purpose is linked to the realised intraday volatility.

Directional o/n vol: minimal spot return at the end of the day. Volatility is a concept that does not assume a rise or fall in spot, but only the size of the moves. This is why it is relevant to consider potential spot moves either way, which correspond to the breakevens of a straddle (refer above graph). When investors buy an o/n straddle with a directional purpose, they are ready to pay its implied volatility only if they expect the spot to move beyond one of the breakevens. So the implied o/n volatility embeds the minimal spot move that directional investors expect on that day.

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms