Please be noted that the implied volatility of at the money contracts of this APAC pair has been inched up at shy above 7% for 3m tenors, while vega instruments of this tenor are signifying the hedgers’ interests in downside risks.

So, the speculators and hedgers for bearish risks are advised to optimally utilize the upswings in short run as the lower implied vols are conducive for option writers.

Hence, AUDNZD's lower IVs with vega’s interest on OTM put strikes could be interpreted as the option holder’s opportunity in the medium run.

The two main risks to our bearish AUD view are that (1) the currency is dragged higher in a more sustained re-rating of the global growth outlook and that (2) better global news and some signs of housing resilience see the RBA play for time. We remain of the view that the RBA will ease a further 50bp in this cycle.

Weighing up above aspects, we eye on loading up with fresh longs for long-term hedging, the more number of longs comprising of ATM instruments and ITM shorts in short term would optimize the strategy.

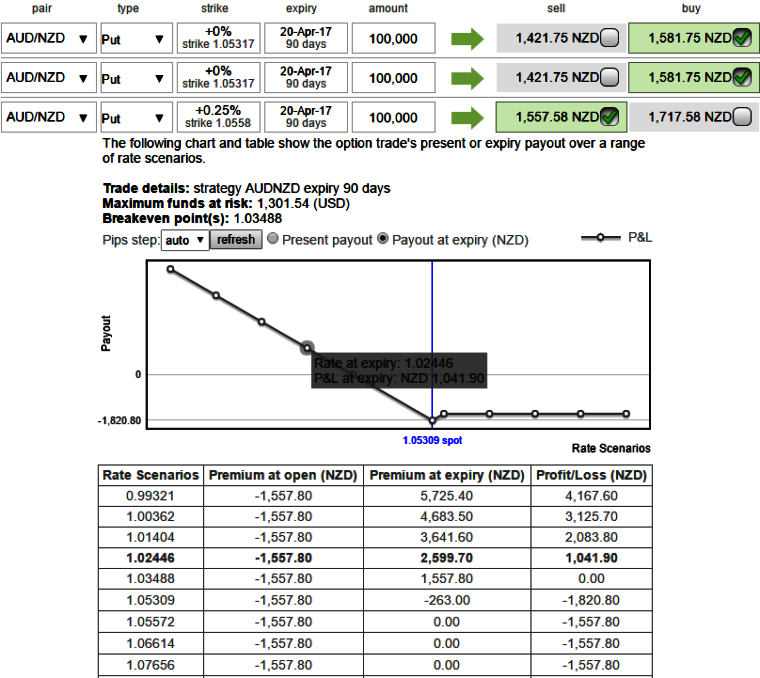

So, the execution of hedging positions goes this way:

Go long in 2 lots of long in 3m ATM +0.49 delta put options, simultaneously, stay short 3m (0.25%) ITM put option, the position may gain if the underlying spot abruptly shows any mild gains. The strategy should be constructed at net debit with net delta at around -0.45.

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure