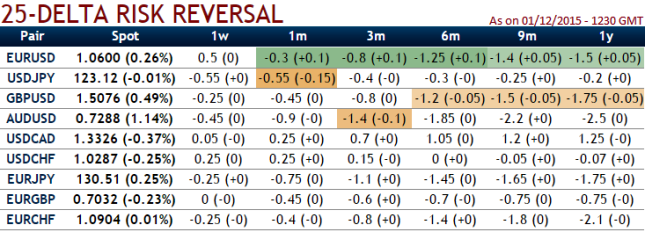

After the brief upswings to 0.7342, the OTC options market appears to be more balanced on the direction of the pair over next 1m to 1y time horizon as hedgers have been cautious on long term downtrend that has lasted since mid April 2013 and as a result delta risk reversal for AUDUSD was turning into negative.

From the nutshell, 25-delta risk of reversals of AUDUSD the most expensive pair to be hedged for downside risks as it indicates puts have been over priced.

As it showed the highest negative values indicate puts are more expensive than calls (downside protection is relatively more expensive).

As a result, AUD/USD has been in consistent supply when the PBoC came out and instigated what had been expected of them in as much of the poor performances of the economy of late. Deep dive into Chinese reserves, we broke apart Q2 data to find it is likely China is a much larger holder of AUD assets than the average reserve manager.

If Chinese reserve drawdown accelerates, we would look for AUD to trade lower. But under our base case, we look for AUD/USD to end Q4 not far from current spot in Q4 (end-Q4 target 0.69).

RBA leaving cash rates unchanged at 2.0% despite upbeat GDP numbers at 0.9% and RBNZ's business confidence is published and came out at 14.6 versus 10.5 keeps us dubious on AUD currency.

FxWirePro: Delta risk reversal re-ignites AUD/USD bearish trend to prolong

Wednesday, December 2, 2015 7:31 AM UTC

Editor's Picks

- Market Data

Most Popular