In our recent post we've learnt that the risk reversals help in various dimensions especially in the context of IVs.

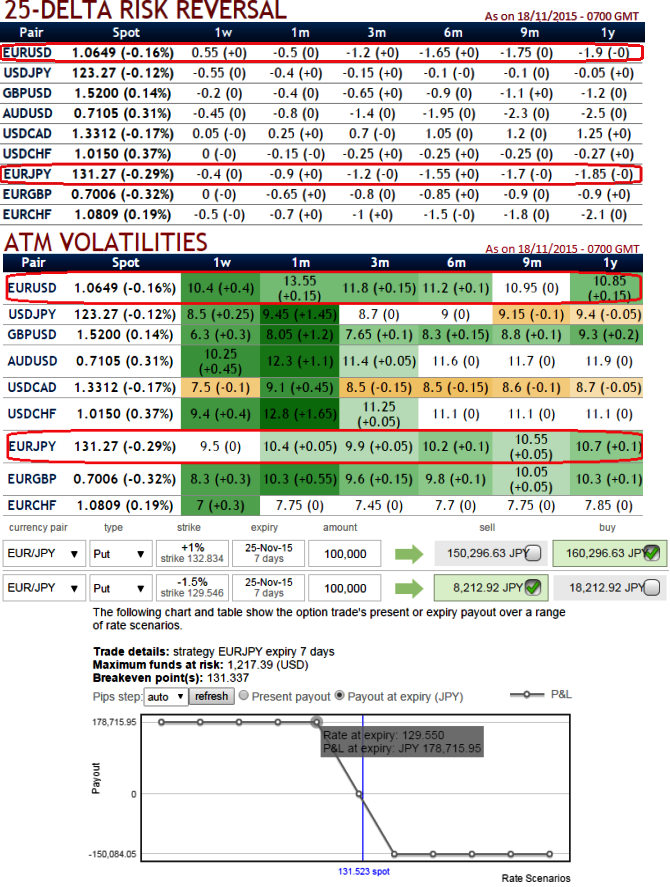

Please observe how delta risk reversal numbers are getting higher negative values gradually in the long run (flashing at -1.85 for 1 year expiries). Volatility smiles most frequently show that traders are willing to pay higher implied volatility prices as the strike price turns aggressively into in the money.

The current spot FX is trading at 131.440, we expect dips extending up to 130.640 levels. It is understood that bearish momentum is bolstering as we saw that from delta risk reversal table. Hence, aggressive bears can initiate strategy using ATM puts as well.

But for risk averse, the challenge now is determining which strikes you should use in this strategy.

The broader the strike difference between short and long puts, the fewer puts you need to sell to cover the price of the long puts.

But at the same time, the coverage of long-to-short is going to be more difficult in the event of assignment.

Unlike a simple naked put, on a long term hedging perspective, debit put spreads serve not only the hedging motives but also reduces hedging costs.

These are advocated as the selling indications are piling up on weekly graph. So buying 15D + (1%) In-The-Money Puts and to reduce the cost of hedging by financing this long position, selling 3D (1.5%) Out-Of-The-Money put option is recommended.

Caution: If you think the pair is going to crash, you should be loading up on put buys in existing strategy. The total cost of the trade is going to be the difference between the prices of the two options.

Since the option you sell will always be lower on the skew curve it means you are getting a better deal on what you are selling compared to what you are buying. It makes this strategy a good one if the skew is running a little hot but EURJPY hasn't rolled over that much.

FxWirePro: Delta risk reversal indicates EUR/JPY overpriced puts but stay short via diagonal debit spreads

Wednesday, November 18, 2015 8:26 AM UTC

Editor's Picks

- Market Data

Most Popular