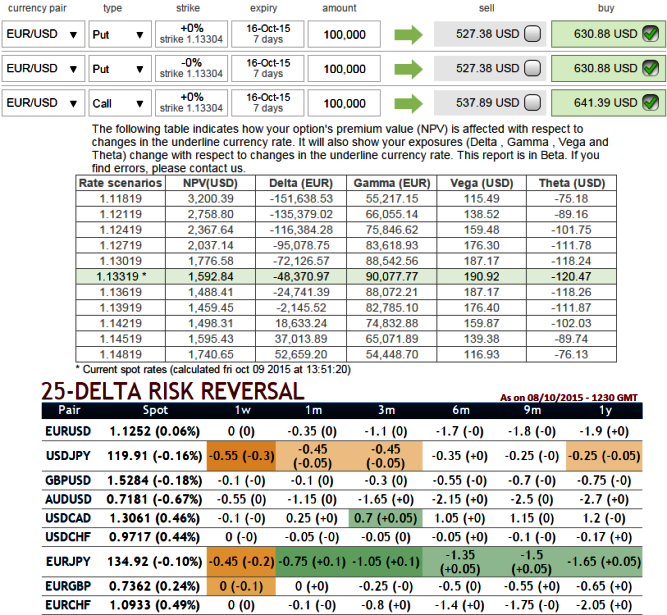

The ATM volatility and delta risk reversal of EURUSD, divulge that the fact that if not now, the pair would experience little downside pressure in next 3-6 months future with reducing volatilities. Although trend is puzzling on either sides we can't deny the fact that the bearish momentum is likely to hold on considering euro zone economic slowdown caused by Germany and Spain, we think inflation concerns mean the ECB is likely to ease policy as early as in October.

We already saw yesterday's German trade surplus shrunk in August as exports plunged. With exports falling almost twice as fast as imports, both exports and imports collapsed during the month, probably reflecting the weakness in sales to Asian emerging countries.

The spot FX EURUSD is ticking up at 1.1344 with negative delta risk reversal has been gradually picking up after 3 months which means fed's rate policy expectation that is scheduled in December cannot be disregarded, an investor may want to protect his asset from downside price risks on euro side. So, he considers buying a EURUSD put assuming scenario that dollar's strength owing to rate hike.

On hedging grounds we are firm on buying ATM 1W 0.52 delta call of 1 lot instead of OTM calls and two lots of ATM 2M -0.48 delta puts on the other hand. You aren't sure of the direction though, but you favor the downside. Our analysis tells you a southward big move is on the table. You enter a long straddle trade with an extra put in hopes of a move down.

If the options are far out of the money they will not appreciate in value fast. Chances are even if a movement comes you may not make sufficient money to make the trade profitable. There are two reasons for this:

Delta of far OTM options is very small. A 1 point movement in EURUSD will not have much effect on the option premium. While theta will also eat premium every day. If the expiry is near and the option is still far, it will actually decrease in value even if the pair moving in its direction. After the news volatility crunches. The option premium will reduce anyway. A buyer has to fight this as well.

FxWirePro: Delta risk calculations suggest diagonal strips on EUR/USD – avoid OTM instruments

Friday, October 9, 2015 8:27 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand