We are emphasizing on long term uncertainties ahead of series of event risks such as Brexit, Grexit and inflationary challenges etc. Various poll surveys still indicate lot of uncertainties lingering around EUR and GBP.

But, until there is real domestically-generated inflation, it is hard to call EUR sustainably higher. Headline inflation has been dragged down by energy prices but even core inflation is soft (particularly in Spain/other periphery countries).

Consumer prices in the Euro Area decreased 0.2% YoY in April of 2016, after showing no growth in the previous month and in line with preliminary estimates, mainly due to lower prices of fuels, heating oil and gas.

Services inflation appears to have troughed but is yet to trend higher (services are 43.5% of consumption basket and depend more on domestic factors/wage pressures). Eventually we think EUR recovers but it will be slow.

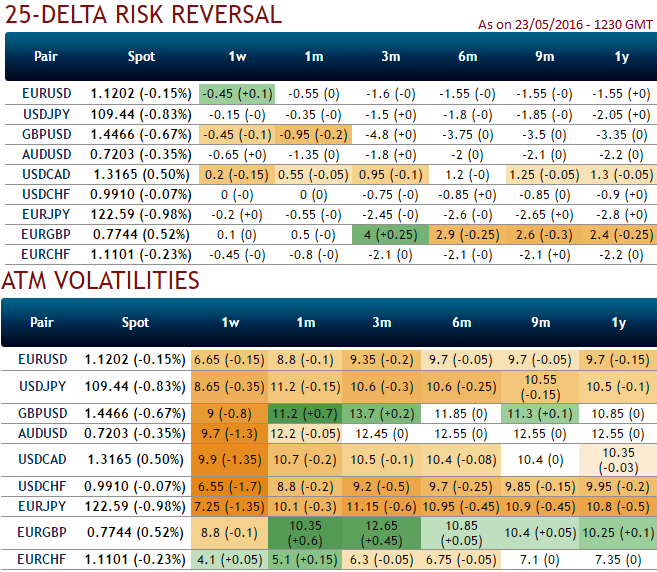

Elsewhere, in OTC markets, risk reversal numbers seem to be indicative of further downside risks in EURUSD and GBPUSD in the months to come. On flip side, Fed hikes before 2017 is also very much on cards.

Keeping risky macroeconomic risky events in mind, we like to bid 3m delta risk reversals of EURUSD and GBPUSD.

The 3m tenor includes the 23 June vote and makes this maturity a natural selection for the hedge. A euro downside optional strategy will linger uncovered for about one month after the outcome, giving the market extra time to digest developments.

Hence, at spot ref: 1.1214, buy EUR/USD 3m put ladder with strikes set at 1.1179/1.0980/1.07.

A move below parity appears excessive given that the market is already well positioned for Brexit risk and that bullish dollar drivers have lost momentum (the Fed stepping back).

The dollar’s decline is already quite significant, and with EUR/USD close to the high end of its range, the odds are currently favouring new euro shorts regardless of developments in the UK.

The skew is even more pronounced for lower strikes, so we get additional leverage in selling a put strike 1.00.

The solution optimizing the hedge leverage in a crisis scenario is an OTM put spread with a tight spread between the low and high strikes.

Our put ladder structure offers a constant payoff between 1.0980 and 1.07 with leverage above 10x times.

Well, to mitigate GBP FX risks, we would still recommend a GBP/USD 3M risk reversals i/o 1Y as a generic hedge for Brexit risk.

The ideal entry point is not ideal given the near doubling of the risk reversal since early October, but the bias is for further widening of the skew in 1H on slow-bleed demand for event protection.

Long side, 2M at the money -0.49 delta puts, 3M (0.5%) out of the money -0.27 delta put and 1W (1%) in the money -0.16 delta put options are recommended.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022