Outperformer Kiwi dollar has extended recent gains, from 0.6905 to 0.6941, helped by a solid GDT dairy auction.

The GDT dairy auction resulted in a 4% rise in prices overall, whole milk powder up 5% (for a total gain of 16% since the early March trough) as was indicated by NZX futures.

Strong support at 0.6850 for a push higher to the 0.7000 area, assuming no negative surprise from the fickle NZ jobs data today. Rising dairy prices and a possibly more upbeat RBNZ next week should be supportive during the week ahead.

NZDUSD in medium term perspectives: The Fed’s tightening cycle plus US fiscal expansion should maintain upside pressure on US interest rates and the US dollar, pushing NZDUSD below 0.6900. The RBNZ’s persistent reminders it is on hold for a long time should also weigh.

Option Trade Recommendations:

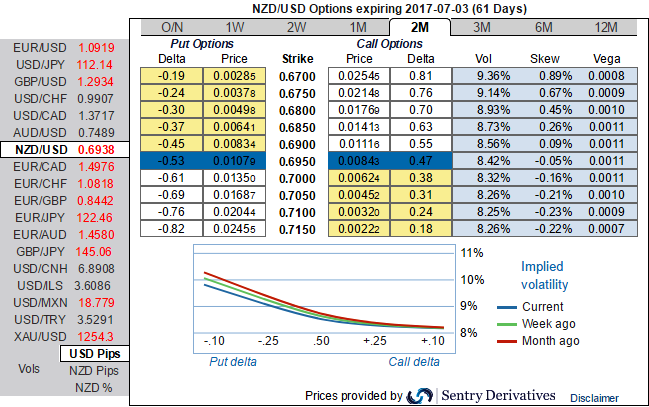

All the factors are discounted in FX options market, you could make out this in mounting risk sentiments as you could see the positively skewed IVs in OTM put strikes in 2m tenors (refer positive IV skews indicate the strikes below 0.69 which is our forecasts).

The NZD volatility market normalized sharply (you could observe that in NZDUSD IV skews across all tenors) and IV skewness is quite favorable for OTM put option holders, hence, we eye on writing overpriced out of the money put options that likely to reduce hedging costs of long legs.

Well, these positive skews in 2m implied volatilities signify hedging interests in downside risks and the combination of IV 2w2m skews suggest credit put spreads that is likely to favour both upswings in short run and major downtrend.

At spot reference: 0.6940, one can also deploy diagonal credit put spreads by writing 2w (1%) in the money put while initiating longs in 2m at the money put, the structure could be constructed at net credit.

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings