From the recent past, there are numerous forecast changes this month for country-specific reasons, but they aggregate to a trade-weighted dollar that would be stable --at best -this summer.

The dollar tumbles a more than one-year low against a basket of currencies on Tuesday as investors grew warier on the short-term outlook although they held off placing more bearish bets ahead of a Federal Reserve meeting starting today.

The EURUSD forecast for Q3 is raised from 1.08 to 1.15but the Q4 raised only from 1.14 to 1.15. We always expected the Bund selloff to lift the euro in 2017 even as the Fed hiked, but we expected US yields to rise more this summer.

USDCAD forecasts for Q3 (1.33) and Q4 (1.31) are lowered to 1.28 and 1.30 given JPM's revised view for Bank of Canada hikes once a quarter through 2018.

The USDCNY end-2017 target is lowered marginally from 6.94 to 6.88 on a more stable economy.

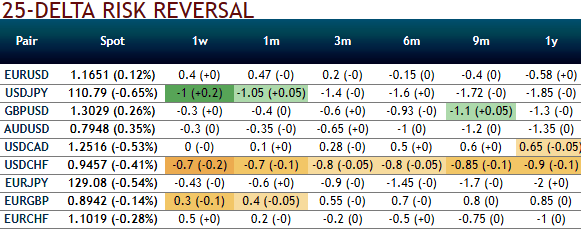

USD risk-reversals should continue to compress (USD calls to cheapen relative to USD puts). USD risk-reversals have under-delivered consistently through the past three years of trend dollar strength, and have been on a compression path in 2017.

As a result, the premium priced for USD calls over USD puts at the beginning of the year was not subsequently justified by the volatility of USD rallies as it became increasingly clear that the Trump administration favored a weaker greenback, leading markets to progressively de-price the likelihood of dollar-positive US fiscal and monetary policy impulses.

This week added another nail to the riskie coffin by adding out-performance of USD puts to go with the softness of USD calls i.e. compression pressure on USD-skews is now two-sided. The inverse spot-vol correlation dynamic (weaker USD, higher vol) observed this week is likely to remain most pronounced in short- expiries that are the most sensitive to near-term spot gyrations.

Hence, sub-3M skews are likely to tighten more aggressively than longer tenors; little surprise then that 1M skews have already flipped for USD puts in a number of pairs, and others like AUD and NZD that haven’t already look on the cusp of breaching the zero thresholds.

While the FxWirePro currency strength index for the dollar amid tepid day as there is no significant data announcement for the day except consumer confidence is indicating extreme weakness relinquishing its yesterday’s stiffness to the bears (-150 highly bearish).

For more details on our index please visit below weblink:

http://www.fxwirepro.com/fxwire/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data