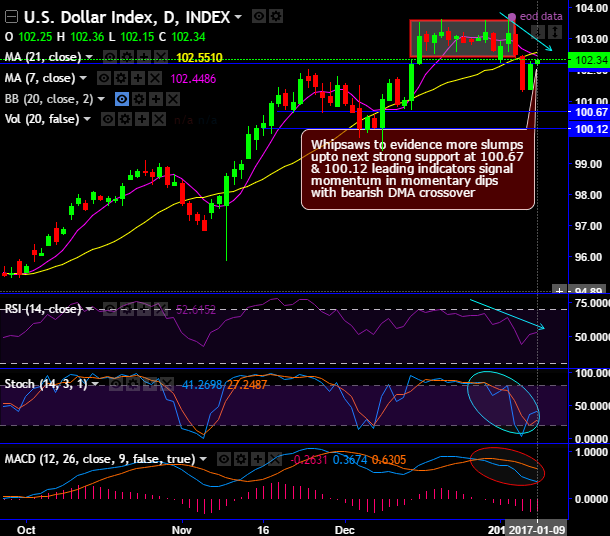

On the daily chart, whipsaws pattern after the upswings evidence slumps below DMAs, more bearish rout on cards after bearish DMA crossover (7DMA crosses below 21DMA), at this juncture both leading & lagging indicators signal bearish momentum.

Although the dollar has been gaining its strength from the last two days against a basket of six other major currency peers, short-term trend seems a bit weaker as you could probably make out from the US dollar index dipping from the recent highs of 103.82 levels to head towards next immediate strong supports at 100.67 levels, not far from the recent lows of 99.43, its lowest level since December 08th.

The current weakness in this index is seen from the bearish candle patterns such as shooting stars at peaks and bear candles with big real bodies that have dragged below DMAs, we traced out Bearish thrusting candle pattern at 101.40 levels yesterday (refer daily chart).

On weekly plotting, long legged doji to evidence more slumps upto next strong support at 100.78, leading indicators signal momentum in momentary dips.

Both leading indicators (RSI & stochastic) on dailies and weekly signal momentum in selling interests. While moving average and MACD on daily chart also indicates the bearish trend in short term.

But on the contrary, the major uptrend still remains intact on monthly charts.

Although FED has hinted more hikes in 2017, Fed Officials See Gradual Rate Hikes as Upside Risks Debated. Federal Reserve officials focused on the impact of potential fiscal stimulus during their December policy meeting, with many starting to worry that the central bank might eventually be forced to quicken the pace of interest-rate increases to head off higher inflation.

While the dollar index (DXY) seems edgy at this juncture but senses strong support at 100.73 levels. To our surprise there seem to be no lingering doubts as to how reliable the news we are being told by the Trump camp are.