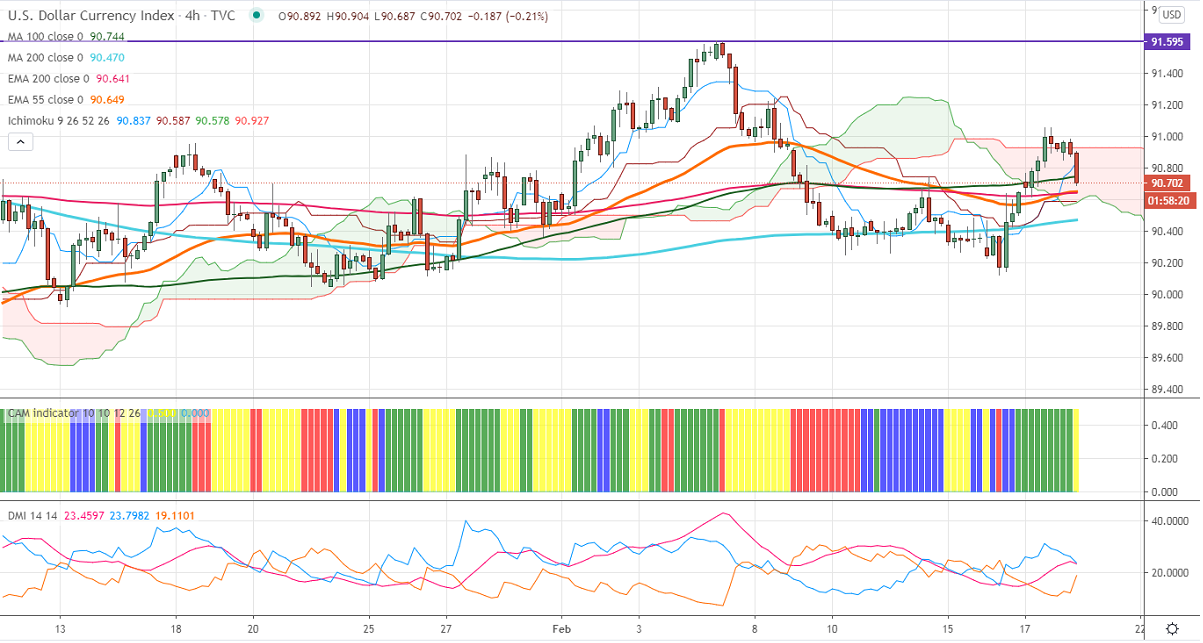

Ichimoku Analysis (4-Hour chart)

Tenken-Sen- 90.77

Kijun-Sen- 90.58

US Dollar index has declined sharply after a minor jump above 91 levels. The index surged more than 1% in the past two days on rising US bond yield. The US 10- year yield hits a multi-year high on hopes of more stimuli from the U.S. The US retails sales rose 5.3% in Jan m/m, the highest jump in the seventh months. Markets eye US initial jobless claims and Philly fed manufacturing data for further direction. The index hits an intraday high of 90.67 and is currently trading around 90.620.

The near-term resistance is around 91.05 convincing close above confirms minor bullishness. A jump to 91.60 likely. Significant trend continuation only above 91.60.

The index facing strong support at 90.40; any indicative break below will take the index to 90/89.35.

It is good to sell on rallies around 91 with SL around 91.60 for a TP of 89.40.