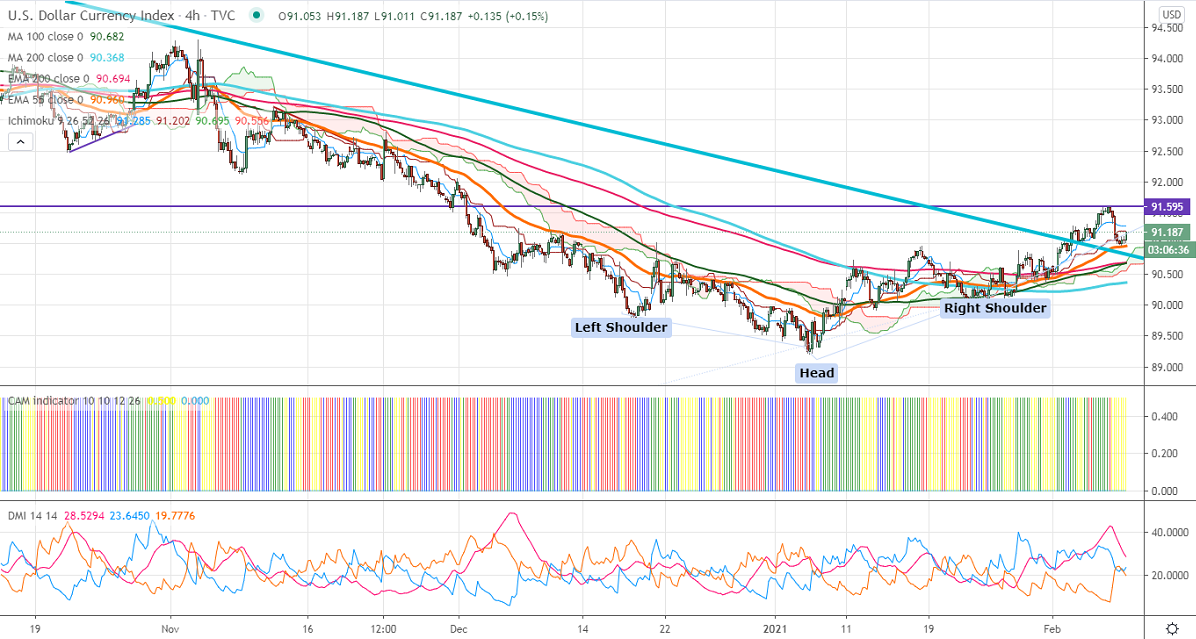

Ichimoku Analysis (4-Hour chart)

Tenken-Sen- 91.28

Kijun-Sen- 91.20

As per our analysis, the US Dollar index has shown a jump to 91.60 the previous week and started to correct. The weaker than expected US non-farm payroll has dragged the US dollar. US economy has added 49000 new jobs in Jan much lower than the estimate of 85K. The previous month was downward revised to -227000. The unemployment rate declined to 6.3%vs 6.7%. economic data is supporting the US dollar at lower levels. Markets eye US CPI, Fed Powell speech on Wednesday for further direction

The near term resistance is around 91.50-60, convincing close above confirms bullish continuation. A jump till 92.05/92.80 likely.

The index facing strong support at 90.65; any indicative break below will take the index to 90.35/90.

It is good to buy on dips around 91 with SL around 90.69 for a TP of 93.