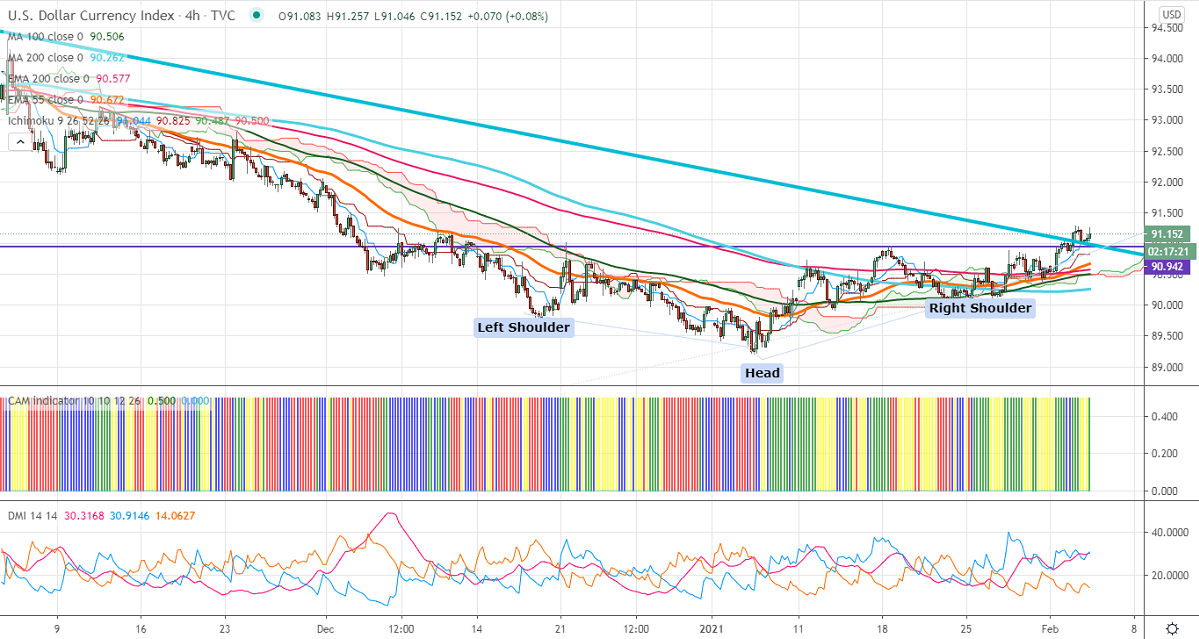

Ichimoku Analysis (4-Hour chart)

Tenken-Sen- 91.04

Kijun-Sen- 90.82

As per our analysis, the US Dollar index is trading higher for 3rd consecutive days. The index is holding well above 91 levels (neckline) and is currently trading around 91.17. The US dollar index is surging despite a jump in the US stock market; the US dollar has an inverse relationship with stocks. The index is in an uptrend as long as support 90.35 holds. The higher bond yields and optimistic US economic data is supporting the US dollar at lower levels. Markets eye US ADP employment data, US ISM services, and Nonfarm payroll data this week for further direction

The near term resistance is around 91.30, convincing violation above targets 91.50. Significant bullishness only if it closes above 91.50. A jump till 93 likely.

The index facing strong support at 90.80; any indicative break below will take the index to 90.69/90.35/90.

It is good to buy on dips around 91.04-05 with SL around 90.69 for TP of 93.