At times, President Trump stances seem to be tougher to empathize. He has been complaining that China exaggeratedly adopted currency devaluation mechanism for the Chinese Renminbi to gain an unfair competitive advantage, which happened yesterday evening again as he tweeted to accuse China of currency manipulation.

This is understandable as the trade deficit of the US widened in May. However, every time he threatens to impose tariffs on Chinese goods to narrow the trade deficit of the US, the Chinese currency always depreciates, which, again, Mr. Trump is unlikely to be happy with either. Even after G20 summit, a question still puzzles us, will a tariff help Trump to achieve his two goals? One is to reduce the US trade deficits, and the other is to force China to strengthen the renminbi. More or so, we believe a lot of people share the same doubt, which somewhat helps explain the sideways movement of USDCNY. But CNY strengthened only modestly this morning, a knee-jerk reaction to Trump's tweet.

Under such scenarios, this is something the authorities may well be keen to avoid in the short term. Related to this point is the fact a sharply weaker CNY may undermine future negotiations. For instance, a rapid depreciation through 7.00 could prompt US retaliation on the remaining goods that aren’t subject to tariffs at the moment.

A derivatives market outlook:

Emerging Asian currencies are vigilant against possible weakness in the Chinese yuan. The US President Donald Trump had notified Chinese President Xi Jinping that a 25% tariff would be levied on the remainder USD325bn worth of Chinese goods. On the other hand, the 12M NDF outright for USDCNY has, for the first time since last November, was started to test the psychologically critical 7 levels again.

OTC FX updates:

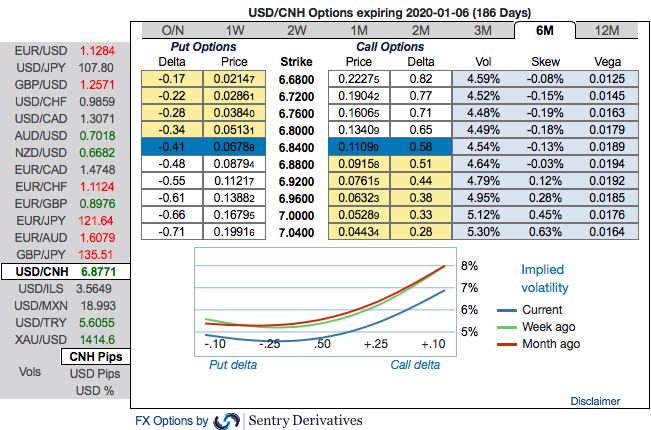

You could easily make out that the positively skewed 3m IVs of USDCNH have been stretched out on either side, whereas 6m skews are indicating upside risks. Bids for OTM call strikes up to 7.04 levels are observed (refer above nutshell). This is interpreted as the hedgers’ sentiments are inclined towards upside risks than the downside.

Trade tips: Buy 6M 40D (6.76 strike) USD calls/CNH puts vs sell 1M OTM calls of 7.10. Courtesy: Sentrix, JPM & Commerzbank

Currency Strength Index: FxWirePro's hourly CNY spot index is inching towards 100 levels (which is highly bullish), USD is at -25 (mildly bearish), while articulating (at 13:32 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes