WTI crude oil pared some of its gains as global growth concerns. It hit a high of $84.25 yesterday and is currently trading at $82.82

According to API crude inventory data, crude oil inventories declined by 914000 barrels compared to a forecast of -150000 barrels. Department Of Energy (DOE) reported inventories in SPR rose by 0.40 million barrels as of June 28th, the highest level since Dec 2022.

Major factors for crude oil price movement-

US dollar index (Bullish)- Negative for Crude.

Major resistance - 106.20/107.

Major support- 105.50/104.

Geopolitical tension- Escalation of tension between Israel and Lebanon ( positive for crude).

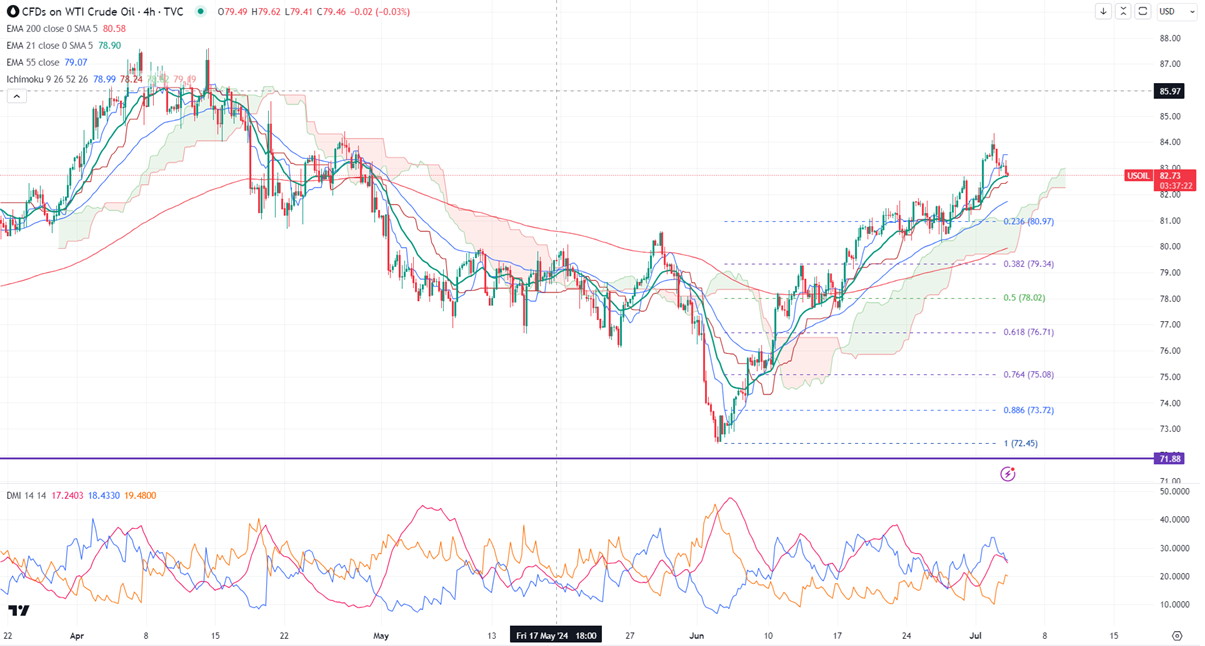

Ichimoku analysis (4- hour chart)

Tenken-Sen- $83.52

Kijun-Sen- $82.42

The immediate resistance is around $83.60. Any jump above the target of $84/$85. On the lower side, near-term support is around $82.60. Any breach below will drag the commodity down to $$81.75/$80.97/80.

It is good to buy on dips around $82.50 with SL around $81.75 for a TP of $85