WTI crude oil lost its shine on easing geo-political tension. It hit a low of $81.29 at the time of writing and is currently trading at $81.31.

According to the Energy International Association, crude inventories rose by 2.735 billion this week, above expectations of 1.373 million.

Major factors for crude oil price movement-

US dollar index (Bullish)- negative for Crude. Major resistance - 106.50/107.20. Major support- 105/103.80.

Geopolitical tension- Escalation of tension between Israel and Iran (Positive for crude)

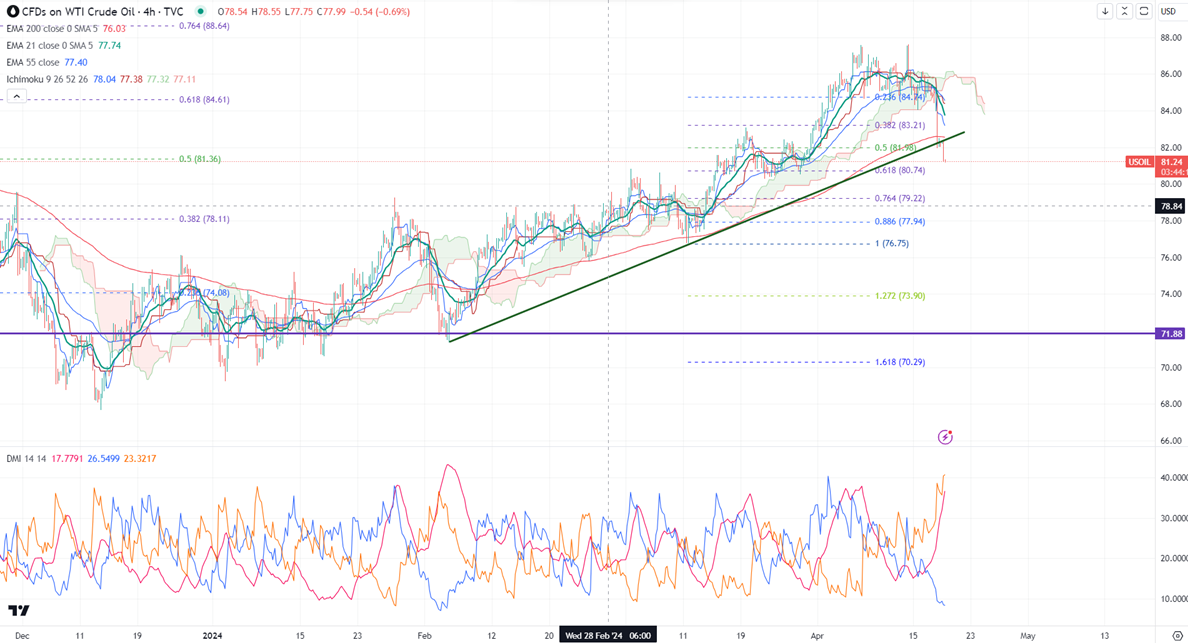

Ichimoku analysis (4- hour chart)

Tenken-Sen- $83.37

Kijun-Sen- $84.44

The immediate resistance is around $82. Any jump above targets $83./$84.20/$85. On the lower side, near-term support is around $80. Any breach below will drag the commodity down to $78//$75.

It is good to sell on rallies around $83.35-40 with SL around $85 for a TP of $78