WTI crude oil showed a minor sell-off in the US session. It hit a low of $84.52 yesterday and is currently trading at $86.02.

According to EIA, US crude stocks rose by 5.8 million barrels for the week ended Apr 5th, compared to an increase of 2.4M bbls. Markets eye ceasefire talks between Israel and Gaza.

Major factors for crude oil price movement-

US dollar index (Bullish)- negative for Crude. Major resistance - 105.20/106. Major support- 103.80/103.

Geopolitical tension- cease-fire talks progress between Israel and Hamas. (Negative for crude)

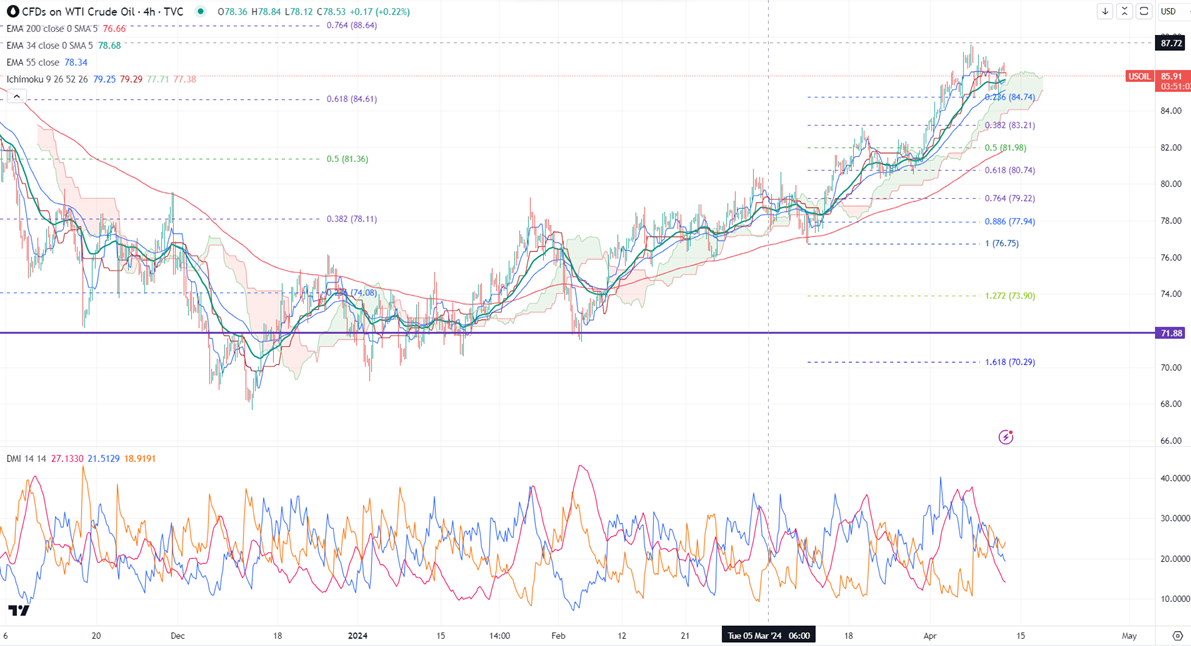

Ichimoku analysis (4- hour chart)

Tenken-Sen- $85.56

Kijun-Sen- $86.06

The immediate resistance is around $87.20. Any jump above targets $88.25/$90. On the lower side, near-term support is around $84.90. Any breach below will drag the commodity down to $84/$83.20.

It is good to buy on dips around $85 with SL around $84 for a TP of $87.20.