WTI crude oil hit a seven-month high due to supply disruption. It hit a high of $87.18 yesterday and is currently trading at $86.56.

OPEC's joint Monitoring committee concluded without changes (production cuts of 2.2 million barrels per day) until the end of June in current supply.

Major factors for crude oil price movement-

US dollar index (Bullish)- negative for Crude. Major resistance - 105.20/106. Major support- 103.80/103.

Geopolitical tension- Escalation of tension between Israel and Hamas, Russia a, and Ukraine (positive for crude)

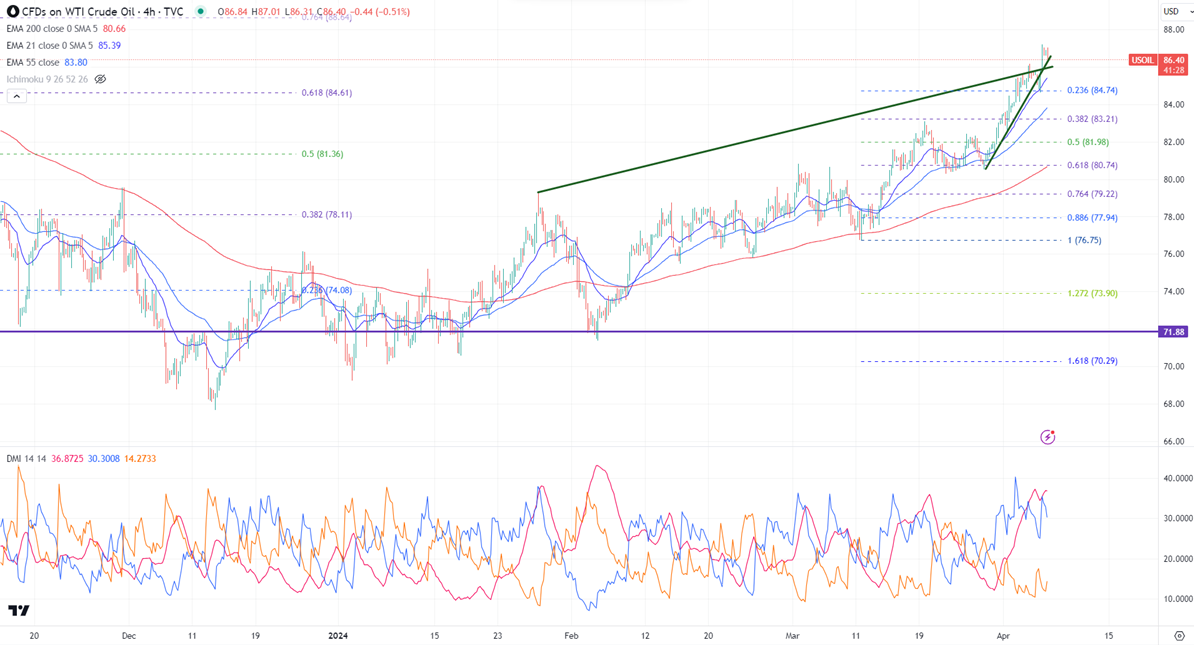

Ichimoku analysis (4- hour chart)

Tenken-Sen- $85.49

Kijun-Sen- $83.82

The immediate resistance is around $87.20. Any jump above targets $88.25/$90. On the lower side, near-term support is around $85.75. Any breach below will drag the commodity down to $85/$84.70.

It is good to buy on dips around $85.70 with SL around $85 for a TP of $88.