WTI crude oil showed a minor pullback ahead of US CPI data. It hit a high of $78.66 and is currently trading around $78.66.

Markets eye demand outlook from three major agencies like OPEC, IEA, and EIA for further direction. The declining demand from major countries like the US and China prevents oil from further upside.

Major factors for crude oil price movement-

US dollar index (Bearish)- Positive for Crude. Major resistance - 104.20/105. Major support- 103.40/102.80.

Geopolitical tension- Escalation of Middle East tension (Positive for crude)

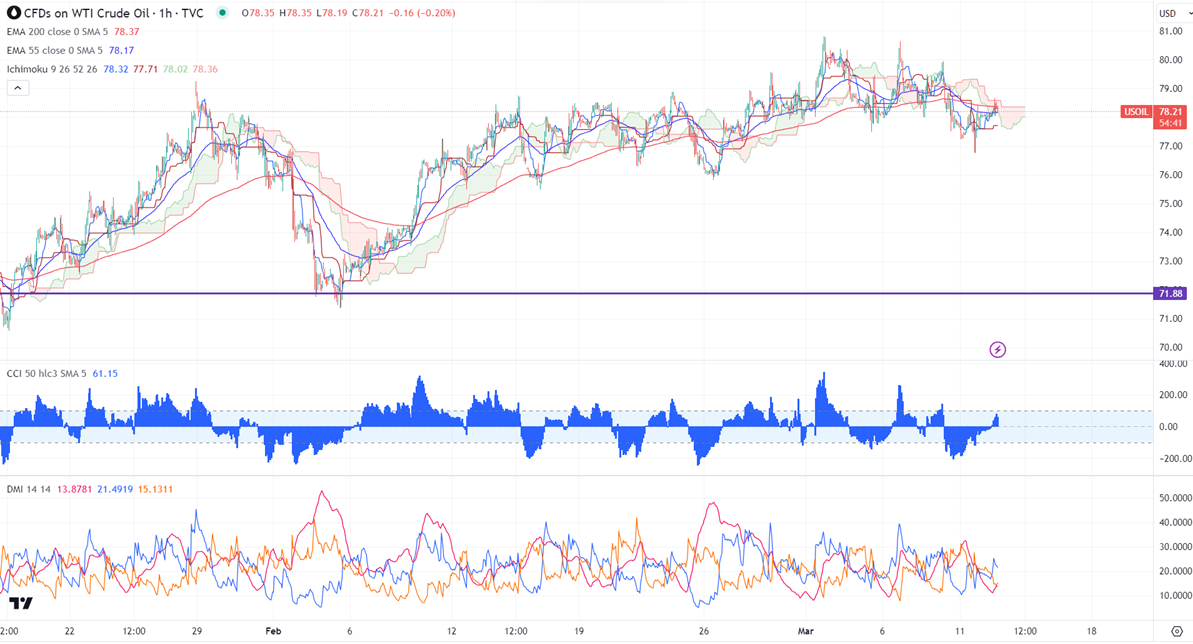

Ichimoku analysis (4- hour chart)

Tenken-Sen- $78.32

Kijun-Sen- $77.71

The immediate resistance is around $81. Any jump above $80 targets $83.50/$85. On the lower side, near-term support is around $77.70. Any breach below will drag the commodity down to $76/$75.51.

It is good to buy on dips around $75 with SL around $73 for TP of $80/$83.