The projections of crude oil are revised for 4Q’18 Brent by $22/bbl to $85/bbl and 2019 Brent by $20.5/bbl to $83.5/bbl. Projections of WTI are also revised for 4Q’18 by $19.8/bbl to $75.83/bbl and 2019 prices higher by $18.58/bbl to $76.8/bbl. The upwards revision in our forecasts is strongly driven by significant supply side risks more than offsetting the expected softness in demand.

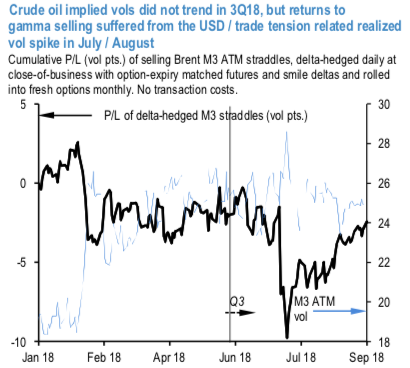

Crude oil experienced a volatile quarter in 3Q’18. The natural hedging-related seasonal uptick in oil vol in Q3 that was anticipated in these pages last quarter was amplified by unexpected dollar strength that triggered a $8/bbl drawdown in flat price in July/August. The sell-off was eventually reversed when EM weakness began to lose some steam, but the climb in realized vol in the interim – trailing 1m Brent delivered vol clocked 34 at its peak – and absence of any valuation cushion in implied vols to begin with meant that gamma selling endured another tough quarter (refer 1stchart) after the travails of the VIX shock episode in Q1.

Realized oil volatility should be contained in Q4, as the snap bullish impact of Iranian sanctions can potentially be offset by a less stressful dollar environment and OPEC and/or US management of the $70-$80 price range heading into the US midterm elections. There is no valuation cushion to be wrong in the view however as Brent M3 ATM vol screens 4-5 pts. too low vs. demand/supply drivers, hence we remain neutral on outright vol recommendations.

A meaningful change over 3Q’18 is that risk-reversals have narrowed sharply, especially in Brent. M12 25D riskies now screen 2 vols too tight in relation to price vs. ATM vol correlation, which has turned sharply negative over the past 2-3 months. Selling puts vs. buying calls should still generate alpha via smile decay even if MTM gains are not forthcoming. Long-dated (>Dec’19) risk-reversals are the best option expressions of strategic bullish crude oil views.

A further widening of the Brent / WTI arb in Q4 is efficiently played via short-dated options. Receive small premium for buying Jan’19 82 strike Brent calls vs. selling Jan’19 73 strike WTI calls as a conditional expression of Brent outperformance vis-à-vis WTI. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards 62 levels (which is bullish), while articulating (at 10:14 GMT). For more details on the index, please refer below weblink:

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?