The most focused on political event in Euro area this year — the French election — is now exactly a month away. Our forecast assumes that mainstream parties prevail, which combined with a less dovish ECB should eventually result in EUR strength. EURUSD forecast is unchanged at 1.08 for 3Q and 1.15 for 4Q.

Polls for the second round of elections (7th May) have shown a modest pickup in favor of Le Pen but Macron’s lead is still large at near 20% (refer above chart) and voting intentions in Macron’s favor now look more secure: the percent of people willing to vote for Macron suggesting that they could change their mind has dropped to 40% from 60%.

Short cable in cash was stopped out, it was a historical week for UK as it submitted the Article 50 notification to the EU on March 29th. As noted last week, we hadn’t expected GBP to respond immediately to this symbolic formality.

Thus far, the initial tone from both sides appears to be somewhat conciliatory but the expectation is that GBP will be vulnerable to negotiations as they unfold.

The EC draft outlining Brexit negotiating outline will be discussed and agreed upon in the EU summit on March 29th, with formal negotiations likely to begin only in mid-May.

In the interim, UK data continues to disappoint with GDP and index of services the latest misses in this regard. Investors came into this week holding record GBP shorts, which is what likely contributed to modest outperformance of GBP despite weaker data and narrower yield spreads vs. most other G10 countries, but the medium-term bearish view remains intact. As noted last week, our cable position was very close to our stop out level and the position stopped out at a loss early on March 27th.

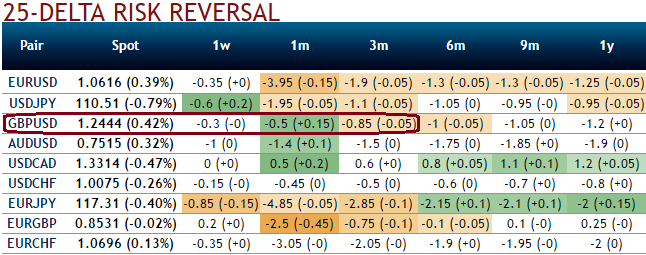

The nutshell showing risk reversals indicate the bearish risks of GBP going forward, 3m bids are extremely bearish biased.

Hold a 2m 0.8820-0.9050 EURGBP call spread. Paid 62 bp March 17, marked at 24bp.

Short GBPUSD from 1.2250 March 3 was stopped out on March 27th but now like to buy 3m risk reversals and initiate shorts via 3m (1%) ITM -0.66 delta puts.

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data