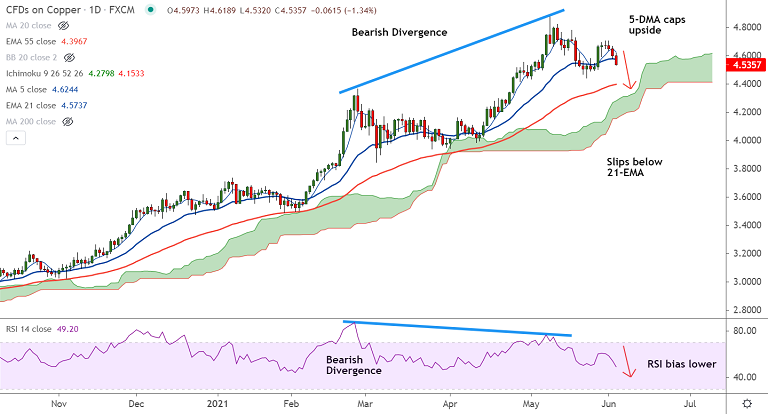

COPPER chart - Trading View

Technical Analysis: Bias Bearish

- Copper slumps over 1.40% on the day, outlook bearish

- Price action has breached 21-EMA support

- RSI has slipped below 50 mark, bias lower

- Bearish RSI divergence on the daily charts keeps downside bias

- 5-DMA has turned and caps upside in the pair at 4.623

- The pair trades below 200H MA and volatility is high on the intraday charts

Support levels - 4.452 (Lower BB), 4.396 (55-EMA), 4.279 (cloud top)

Resistance levels - 4.570 (21-EMA), 4.618 (5-DMA), 4.629 (20-DMA)

Summary: Copper is on track to extend pullback. Scope for test of 55-EMA at 4.395.