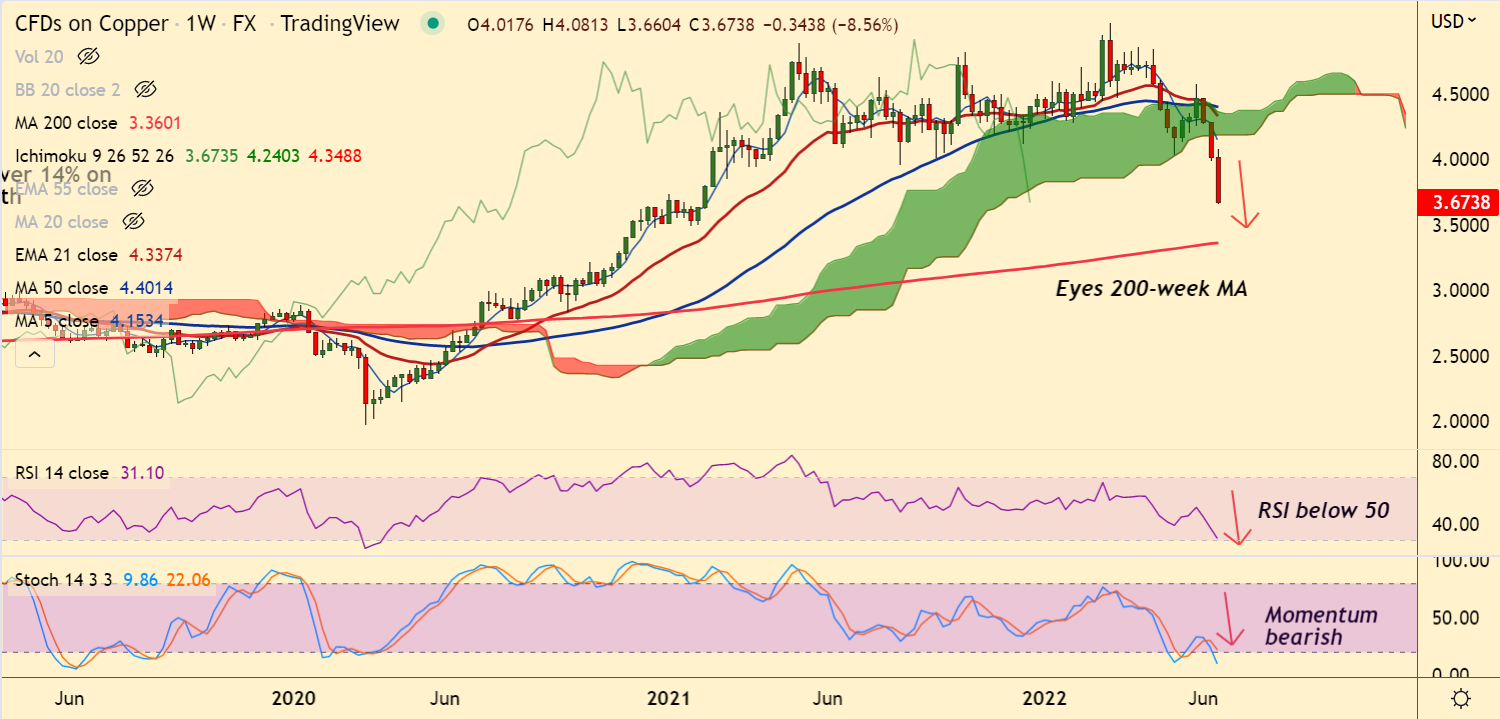

Chart - Courtesy Trading View

Copper prices extend decline, hit fresh multi-month low at 3.6697, levels unseen since Feb 2021.

Concerns that steep interest rate hikes by major central banks will hurt the world economy is dampening commodity prices.

Copper is heading for its steepest weekly drop since March 2020, is down nearly 14% for the month till date.

Investor fear that slowing economic growth will dampen demand for the metal used in solder for electronics.

Global rating agency Fitch said, “We expect base metals to extend losses following their recent fall caused principally by the Fed's tightening and China's economic slowdown on the back of the country's zero-COVID policy.”

Technical indicators for the base metal also indicate further downside in price. Little support seen till Feb 2021 low at 3.4960.

Breach below 3.4960 (Feb 2021 low) will take the pair lower to test 200-week MA support, currently at 3.360.