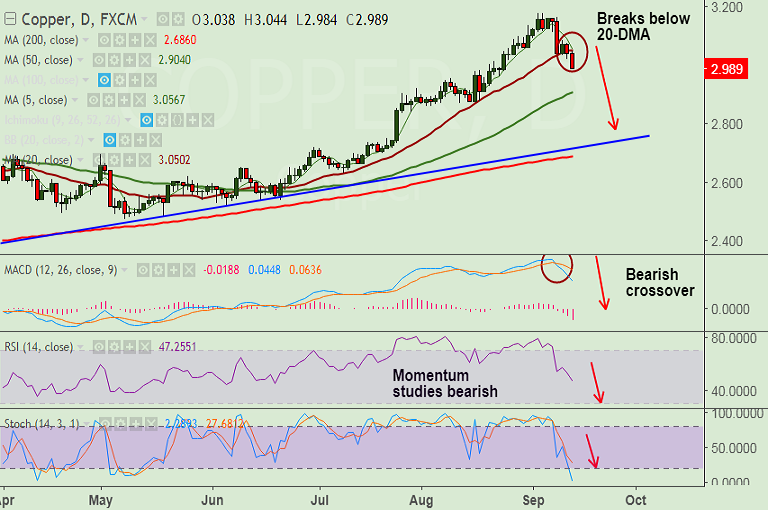

- Copper is extending correction from multi-year highs at 3.176 hit last week.

- Price has slipped below W 5-SMA at 3.0238 and technical indicators have turned bearish on daily charts.

- RSI and Stochs are on verge of rollover from overbought levels on the weekly charts, confirmation of which would see further downside.

- Price action on daily charts has breached 20-DMA support at 3.0502, bias lower.

- We see next immediate support at 50-DMA at 2.9040, violation there would then see test of 200-DMA at 2.6860.

- Momentum studies are bearish, RSI and Stochs are sharply lower, MACD is showing a bearish crossover.

Support levels - 3.0, 2.9040 (50-DMA), 2.7446 (100-DMA), 2.6860 (200-DMA)

Resistance levels - 3.0502 (20-DMA), 3.0564 (5-DMA), 3.176 (multi-year)

Recommendation: Good to go short on rallies around 2.99/2.9940, SL: 3.050, TP: 2.9040/ 2.90/ 2.875

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest