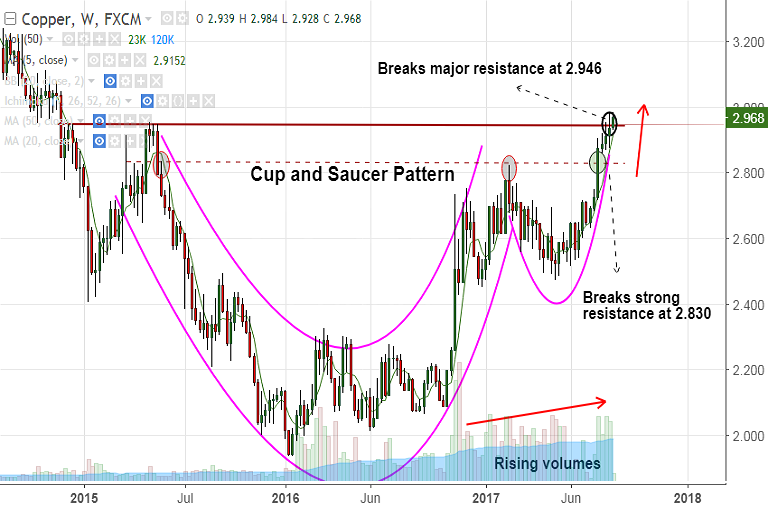

- Copper has hit fresh 3-year highs at 2.984 before edging lower to currently trade at 2.970.

- It has completed the 'Cup & Saucer' pattern raising scope for further upside.

- Strong resistance at 2.496 has been breached and we see extension of bullish trend.

- Technical indicators on weekly charts also support upside. RSI above 50 and biased higher. MACD also supports uptrend.

- 200-DMA at 2.90 is strong support, break below could see minor weakness.

Support levels - 2.946 (trendline), 2.9310 (5-DMA), 2.9002 (20-DMA), 2.9158 (weekly 5-SMA)

Resistance levels - 3.0, 3.335 (61.8% Fib of 4.20 to 1.936 fall)

Recommendation: Good to go long on dips, SL: 2.90, TP: 3.00/ 3.069/ 3.115